I

Introduction

The subject of much writing has been on how the for-profit industry may increase earnings and create long-term financial plans for expansion and success. Sadly, there is a dearth of literature on nonprofit organisations especially in the area of a business plan.

Fundamental knowledge of management, planning, accounting, and finance is typically lacking in non-profit organisations. Without effective management and leadership, the organisation collapses, struggles financially, and runs the risk of turning into a liability rather than a force for good in society. Hence, a highly iterative process and business plan offer substantial short- and long-term advantages. Business planning is an effective tool for short-term alignment toward major impact. Though business plans have historically been the domain of the for-profit industry, non-profit organisations can also benefit greatly from using them as a tool.

II

What is a Business Plan?

A business plan is a management tool that can help organisations navigate a changing environment. What your organisation does and how it will be run are described in the business plan. It offers a framework for tracking and assessing development and outlines the organisation’s aims and objectives.

“Business planning” is the phrase used to describe the process of creating an extensive document outlining an organisation’s goals and strategy for success. Nevertheless, some refer to this group of tasks as “strategic planning.” Through the business plan process, an organisation can examine how its mission statement is implemented in the various programs and activities that make up its daily operations.

By and large, creating a business plan is an opportunity to use quantitative and qualitative data along with the enthusiasm and dedication to clearly state the precise results your organisation hopes to attain. It also entails demonstrating how the various initiatives can result in tangible, quantifiable change for the people you serve.

One of the most beneficial parts of a business plan is examining existing programs in-depth. Also, it requires making an inventory of what is missing, what may be improved, and what is working effectively. Without a clear picture of the existing situation, you can’t assess what your nonprofit is best positioned to do or what adjustments to make in your programs and services. Hence, you have to identify your organisation’s strategic priorities.

III

Critical Statistics to Consider

In this section, we will consider various Statistics that indicate the importance of a business plan across organisations.

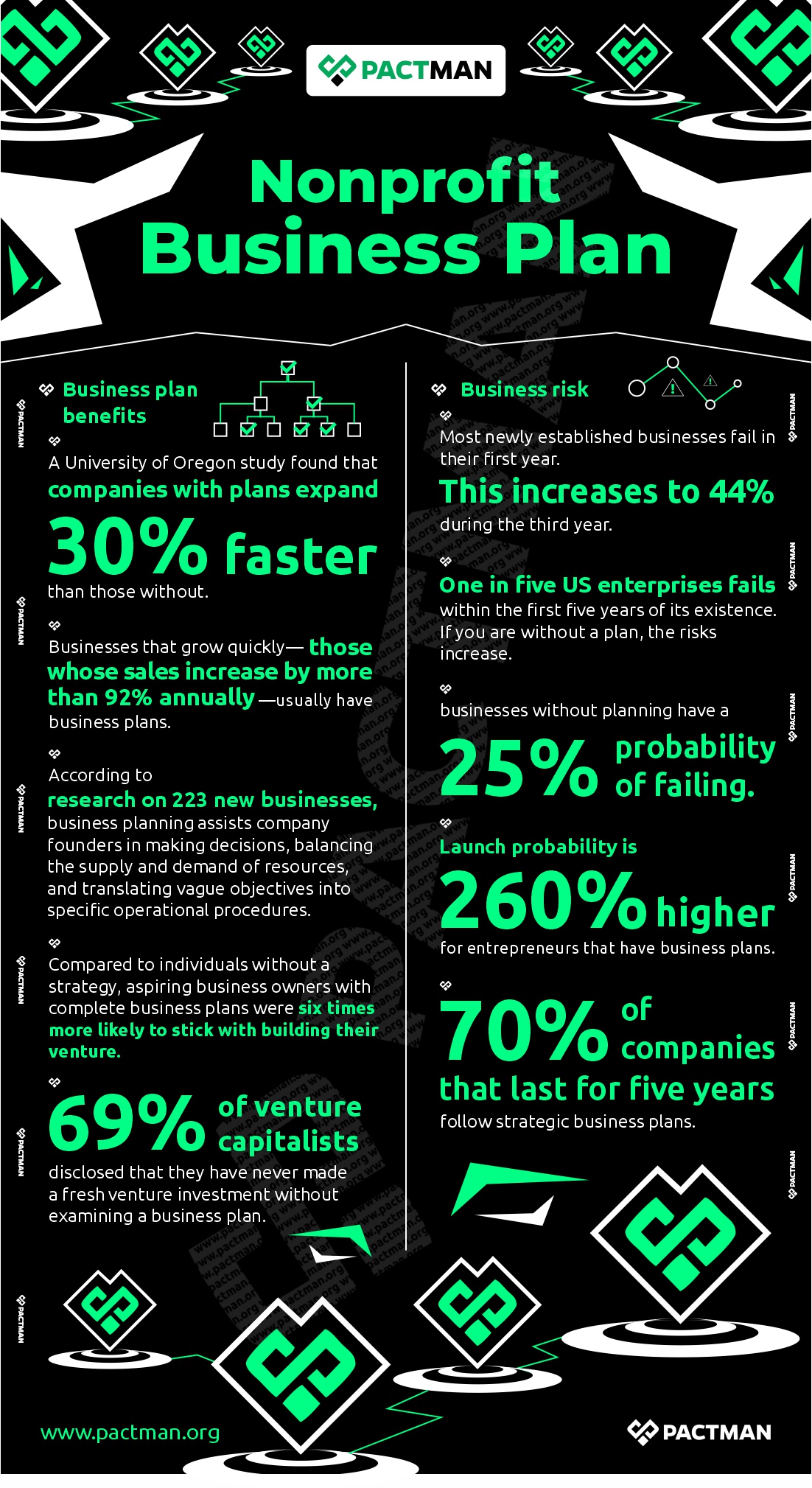

a. Business plan benefits

A University of Oregon study found that companies with plans expand 30% faster than those without. According to another study, businesses that grow quickly—those whose sales increase by more than 92% annually—usually have business plans. Also, business plans are present in 71% of businesses that are growing quickly.

According to research on 223 new businesses, business planning assists company founders in making decisions, balancing the supply and demand of resources, and translating vague objectives into specific operational procedures. Compared to individuals without a strategy, aspiring business owners with complete business plans were six times more likely to stick with building their venture. 69% of venture capitalists reported that they have never made a fresh venture investment without first examining a business plan.

b. Business risk

Most newly established businesses fail in their first year. This increases to 44% by the third year. Also, one in five US enterprises fails within the first five years of its existence. If you are without a plan, the risks increase.

One to two years into their existence, businesses without planning have a 25% probability of failing. Launch probability is 260% higher for entrepreneurs that have business plans. 70% of companies that last for five years follow strategic business plans.

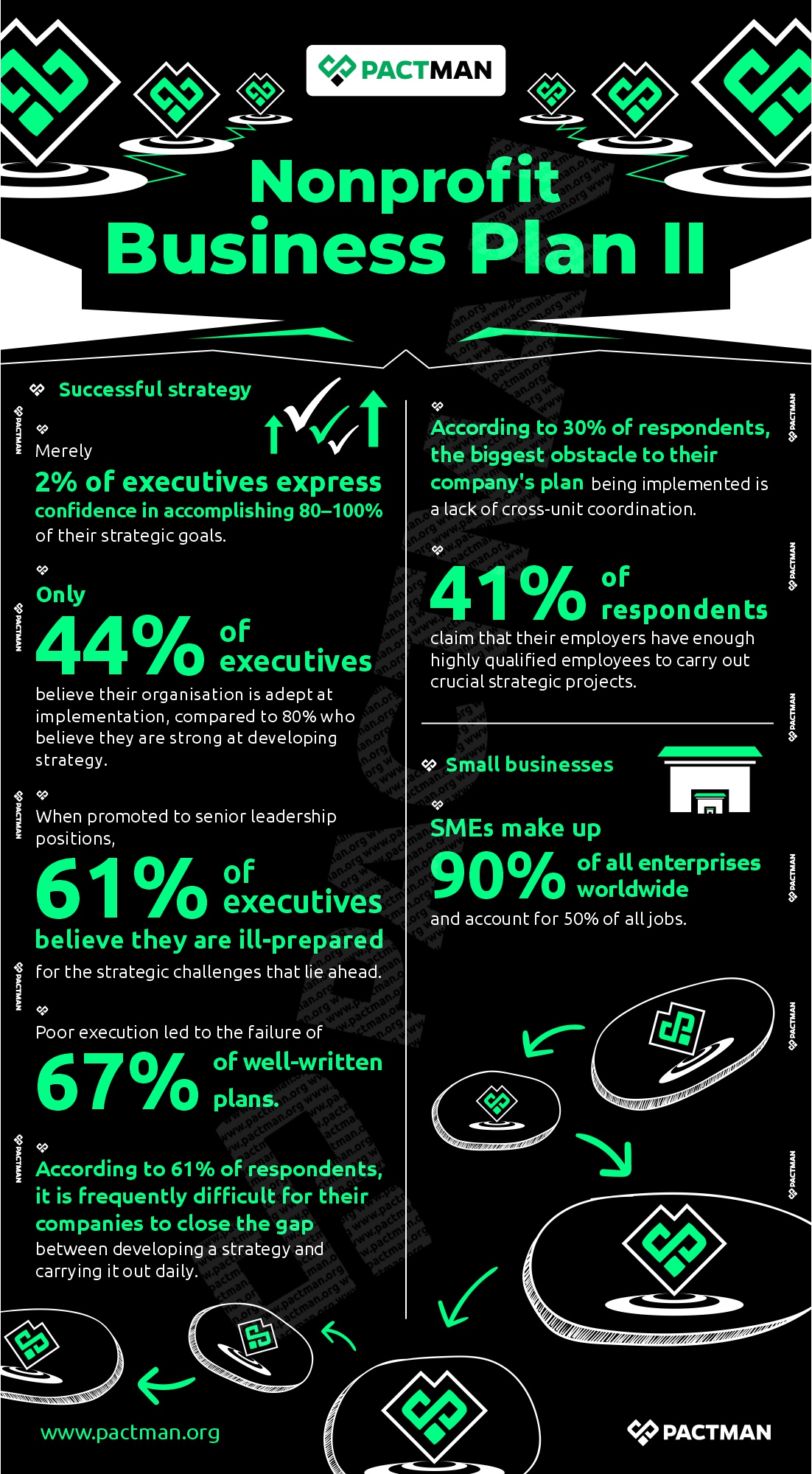

c. Successful strategy

Merely 2% of executives express confidence in accomplishing 80–100% of their strategic goals. Only 44% of executives believe their organisation is adept at implementation, compared to 80% who believe they are strong at developing strategy.

When promoted to senior leadership positions, 61% of executives believe they are ill-prepared for the strategic challenges that lie ahead. Consequently, poor execution led to the failure of 67% of well-written plans.

According to 61% of respondents, it is frequently difficult for their companies to close the gap between developing a strategy and carrying it out daily. Also, the biggest obstacle to their company’s plan being implemented, according to 30% of respondents, is a lack of cross-unit coordination. In addition, Just 41% of respondents claim that their employers have enough highly qualified employees to carry out crucial strategic projects.

d. Small businesses

The World Bank claims that small and medium-sized businesses constitute the foundation of the global economy. SMEs make up 90% of all enterprises worldwide and account for 50% of all jobs.

IV

Importance of a Business Plan

Following the completion of the organisation’s strategy, the business plan should be created. The business plan can be leveraged as a management tool in:

- Setting performance standards;

- defining clear goals and objectives;

- encouraging efficiency;

- seeing areas for improvement;

- raising funds; and

- directing the application of capacity-building techniques

Typically, business plans are updated once a year, if not twice a year, or more if new financing and program opportunities become available. Usually, a feasibility study considers the initial step in deciding whether or not to move on with a new enterprise. A newly approved program by the board and management has to be incorporated into a revised business plan.

The business plan serves as the primary tool for donors or investors when requesting money, finance, or significant contributions since it thoroughly describes the organisation’s operations. As a result, the business plan must highlight the organisation’s capabilities and be seen as a major communications tool.

Do not forget that there is no one-size-fits-all plan. Likewise, it is important to write a business plan with a specific audience in mind. You must include information that a bank or corporate investor finds significant. This is especially true if you are utilising the business plan to approach them about financing. For instance, you should make it obvious how important your goal is to the neighbourhood and how the corporation will profit from it.

V

Tips to Consider When Writing a Business Plan

In this section, we will highlight some of the crucial aspects to consider in the creation of a business plan.

1. Determine Strategic Priorities

The first phase is essentially diagnostic. It involves a detailed examination of each program’s existing operations. You can use internal data to identify the strengths and weaknesses of your organisation. This may entail evaluating the program model’s fidelity or reviewing participant or site results. Examining external sources is another crucial aspect of business strategy. For instance, you could consider how well your organisation is going to perform in comparison to other nonprofits. Also, look into funding or public policy trends to discover any changes that might have an impact on your nonprofit’s capacity to meet its objectives. A “one size fits all” method for figuring out strategic priorities does not exist.

2. Decide organisational structure

Secondly, deliberate on the best organisational structure before commencing any new projects. The easiest solution is usually to run the new endeavour or activity within your current structure. In any case, you need to weigh the benefits and drawbacks of any arrangement.

If you were considering creating a subsidiary, for instance, you may want to consider the following questions:

- How much control would my organisation have over the subsidiary?

- Will most of the board members of the subsidiary also be members of my current nonprofit’s board?

- Will the objectives, vision, and mission of the subsidiary align with or diverge from those of the parent organisation?

- How will the subsidiary’s establishment be financed by the current nonprofit?

- How will the two organisations manage their financial statements at the end of the year?

- In the community, it serves, how will the recently formed subsidiary affect the reputation of the current non-profit?

You should also consider if it’s best to establish the subsidiary as a for-profit or non-profit entity. In addition to having more overall operational independence and the capacity to write off losses, for-profit businesses can access funds than nonprofits. Naturally, one of the main drivers of success is financial gain. However, the drawback is that your for-profit business will owe money in taxes. Also, the pursuit of profit has the potential to supersede the interests of the community, shareholders, and investors, as well as the needs of workers and the development of new jobs.

3. Understand Resource Implications

After reaching a consensus on the organisational structure of your business, it’s important to consider the real-world effects. This stage of business planning aims to match your personnel, assets, and budget in a way that will facilitate long-term execution.

The first step towards achieving alignment is to be realistic about the amount of work required to execute each of your priorities. The next step is to assess how much more the business can handle in light of its current resource levels. Next, identify any areas that require hiring more staff or making infrastructural investments. Afterwards, you should be able to make financial estimates. This will assist you in understanding the necessary adjustments to your budget. An initial look at the financials is usually enlightening for most firms. It turns out that they have to reevaluate the rate of change and modify their aim.

4. Understand Financial Implications

Once the infrastructure and personnel are under control, it’s time to determine the cost of implementing the new plan. Does this seem like a feasible pace of growth when you set it all up? Take into account your organisation as well as the external financial climate while responding to this question. Also, consider how well your nonprofit can handle a bigger budget and how it can affect the organisation’s culture.

Another useful reality check is to examine how the required investments will impact your cost per outcome. There is nothing more frustrating than coming up with a brilliant strategy only to discover that you lack the funds to carry it out. You can determine whether your nonprofit can generate enough funds to support the new strategy by looking into the financial situation. However, there will always be a non-trivial degree of uncertainty, regardless of how detailed your financial estimates are. This risk can be managed by outlining two or three financial scenarios. The goal is to help you decide in advance what your nonprofit might prioritise under various funding conditions.

A stretch scenario and a delayed scenario might be of interest in addition to the core budget. This can help you brainstorm potential responses to unexpected cash shortfalls or the inclusion of a sizable new funding source.

5. Stay on Track

Lastly, understand that planning a business takes a lot of discipline; putting it into practice requires even more. As a result, establishing benchmarks is crucial because it allows you to monitor progress and assess if you’re on track. A more concentrated set of milestones, commonly referred to as a dashboard, can aid the management team in tracking high-level development.

To show dedication to the new strategic direction and advancement in putting it into practice, many organisations utilise a modified version of the milestones in their communications with funders and other supporters.

V

Importance of a Feasibility Study

A feasibility study is a procedure intended to investigate the viability of starting a new firm, expanding current services or markets, or launching a new program. The procedure always proceeds in the same way, regardless of the project. Essentially, the organisation uses the feasibility study as its main tool to determine whether a project is feasible and whether it has the resources to run a new or expanded business.

A comprehensive review should be part of a feasibility study and should be finished in a short amount of time—roughly 30 to 45 days. The organisation must conduct market research to ascertain the scope of the need, possible obstacles and disputes, as well as opportunities for growth and fulfilment. Data is obtained through the study process in order to discover probable liabilities, prospective benefits, and resource demands.

To begin with, a feasibility study is not a pitch for a product. It is not intended to encourage business ventures, but rather to investigate and evaluate the benefits and drawbacks of moving forward with one. When carried out correctly, the feasibility study offers the board and management a compelling evaluation of the possible rewards and dangers of the new enterprise. Upon receipt of the finished report, the board, management, and employees will be able to make an informed decision. Afterwards, they ought to hire someone to draft a more thorough strategy. This strategy would then be integrated into the organisation’s larger business plan. The feasibility study offers a credible evaluation of risks and benefits and allows the company to evaluate new enterprise opportunities with respect to its capabilities.

An entrepreneurial mindset

Developing an entrepreneurial mindset entails identifying the nonprofit organisation’s weak points and areas that require improvement. It also includes:

- Determining the knowledge required to shore up those weak points and enlisting influential people who are eager to offer their knowledge.

- Ensuring that the operations and culture of the organisation foster an entrepreneurial attitude.

- Seeking management and employees who are driven, imaginative, and visionary.

- Creating model services or programs that are replicable and implementable in multiple markets.

- Developing transferable systems and user-friendly efficiency for clients, both internal and external.

- Establishing a procedure for ongoing, reciprocal contact between the group and the community.

Conclusion

Throughout the business-planning process, the nonprofit’s decision-makers have a unique opportunity to take a step back and consider their organisation as a whole. Hence, it is essentially the best time to make the connections between the nonprofit’s mission and its programs, outline the program resources, and set up performance metrics to know if the intended outcomes are being attained. A business plan promotes strategic thinking both during and after the plan’s creation. Also, implementation presents new obstacles and necessitates making trade-offs and judgments.