A nonprofit organization can be protected by an investment strategy. This helps ensure that financial decisions are made with the organization’s best interests in mind. Eventually, good financial management procedures guarantee an organization’s long-term viability.

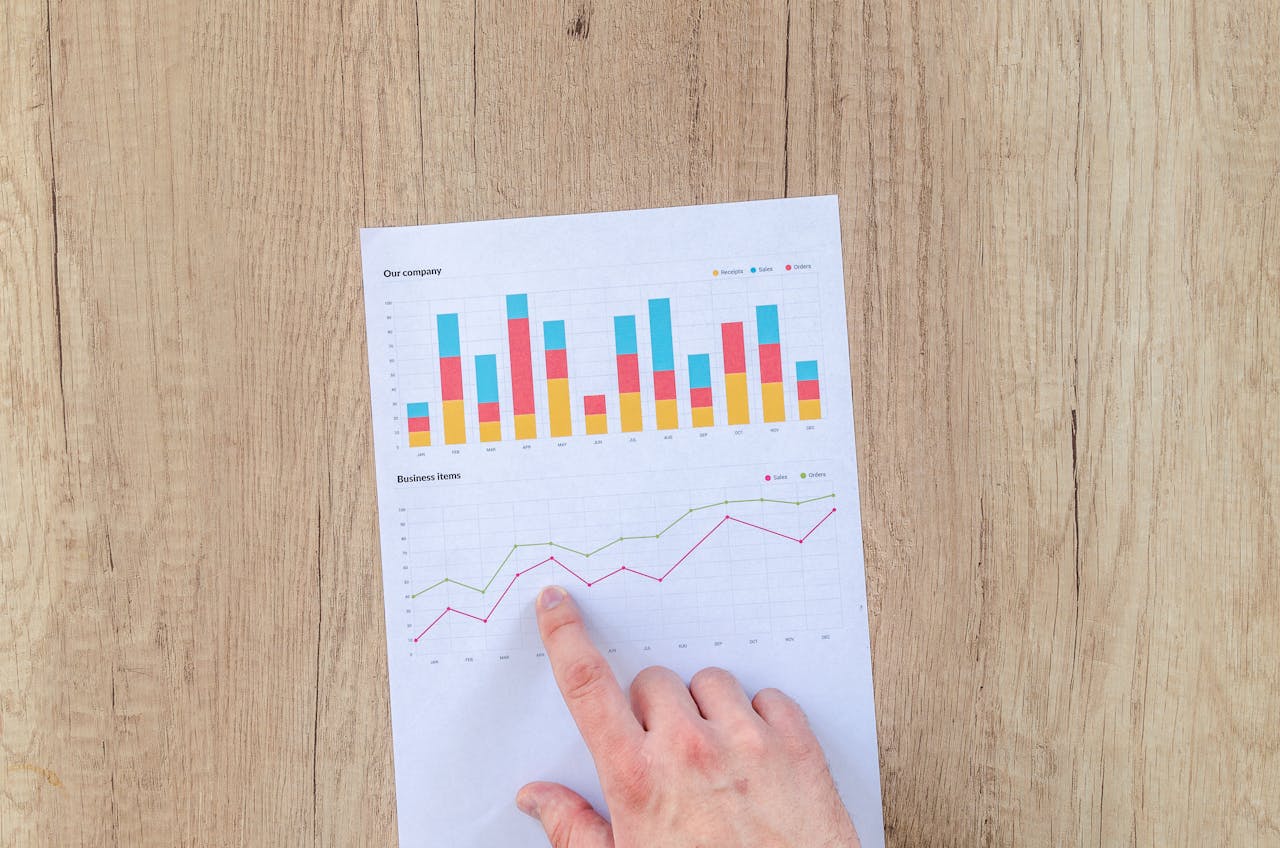

- Reputable nonprofits with substantial funding often invest a portion of their assets in stocks, bonds, and other securities to bolster their financial position.

- Boards may choose to assign a committee the task of managing investments.

- Investigate the best investment practices, approaches, and insights to support the investment activities of your nonprofit.

Experts advice on the importance of a nonprofit investment strategy

In this article, we will highlight crucial reasons why nonprofits should consider an investment strategy.

1. Funding Growth

According to Christopher Brown, founder of Brown Miller, “a well-thought-out investment strategy is crucial for any non-profit, endowment, or foundation to sustain and potentially grow its funding base.” Essentially, prudent financial planning requires that boards set aside a specific amount of cash for investing.

Hence, “if you are responsible for managing an endowment, foundation, or non-profit, investment management consulting can help you prudently manage funds while avoiding potential risk exposure.”

Brown further stated that “the investment management consultant that you select should be fully aware of your organization’s goals, principles, and values. Their focus should be solely on meeting your organization’s financial goals, assuming the investment strategies fall within your risk tolerances and align with your core values.”

Likewise, boards may choose to assign a committee the task of managing investments. Although committees can be assigned, the board however retains the task of managing the committee as well as investment control.

2. Supports Organizational Goals

Secondly, nonprofits should consider an investment strategy as it provides an effective way to ensure financial sustainability. True Alpha, a wealth management platform states that “nonprofits cannot survive on donations alone so they need to be smart about their investment strategy. Their portfolio needs to achieve growth and attain sustainability so that it can support the goals of the organization.”

Without a doubt, a nonprofit investment strategy constitutes a crucial need for nonprofits that seek long-term financial growth. The wealth management platform also reiterates that “with the tremendous changes in the investment options over the last few decades, it is now possible for even small to mid-sized nonprofits to have a diversified low-cost strategy. This includes “proper portfolio construction, which complies with the organization’s investment policy statement.”

3. An investment strategy can guarantee long-term profit

Jemina Boyd, a marketing expert and content writer states that “nonprofits often operate on a shoestring budget for extended periods of time to achieve their goals while working to build up a reserve fund. However, if you leave that money sitting in a money market, CD, or savings account, it’s likely losing value given the current inflation rates.” On the other hand, nonprofits can create an advantage by making their funds work for them.

According to Jemina, “the idea of your hard-earned money losing value is enough to convince many organizations that it’s time to invest.”

To begin with, investigate the best investment practices, approaches, and insights to support the investment activities of your nonprofit. Make sure the goals of your organization are fulfilled by practicing responsible and moral financial management.

4. Good benefits for small nonprofits

In the words of Scott Eichar, a business advisory consultant, “you may think that only large, well-endowed not-for-profits require the advice of an investment manager. But even smaller nonprofits with modest endowments — particularly smaller nonprofits that don’t have in-house financial expertise — can benefit from hiring an investment professional.”

An investment consultant ensures that an organization adopts a strategy that aligns with its goals. Hence, “finding the right investment consultant for your organization starts with identifying a pool of qualified candidates with proven track records. Ask for referrals from local private foundations (possibly ones that have funded you in the past) or other area nonprofits. Also, members of your board may know investment managers they can recommend. Qualified candidates should have experience working with nonprofit endowments.”

It is common for nonprofit boards and investment committees to prefer collaborating with outside consultants. This is largely because it reduces risks and maximizes benefits as experienced, specialized advice can guarantee certainty. However, even when collaborating with outside parties, the investment committee must ensure that the strategy is in line with the organization’s long-term goals, risk tolerance, and liquidity needs, among other factors.

5. An investment strategy ensures sustainable operations

Lastly, Marta Ferro, a nonprofit co-founder and content writer posits that “an organization is worthy of investment if it’s having a concrete, positive impact in the community and it’s run well enough to maintain operations sustainably.” Now more than ever, nonprofits should have an investing strategy to direct their long-term financial security, regardless of their size or purpose. An organization’s long-term survival depends on it.

“Exceptions include startups that have exciting potential but may not be far enough along in their lifecycles to show trackable, long-term impact or demonstrate sustainability,” says Martha. Also, “organizations launched by, from, and in the communities being served are often the most deserving of investment interest and consideration.”

In conclusion, an organization’s investment strategy ought to be as detailed as possible. The strategy should act as a guide that the board should adhere to when allocating institutional finances. Also, board members must keep a close eye on the investments as they take time to mature.

As we all know, there is risk associated with any investment. As a result, boards shouldn’t make long-term investments with all of the nonprofit’s financial resources. Additionally, prudent financial planning mandates that boards set aside a specific amount of operating cash for immediate utilization.

Conclusion

More often than not, nonprofit organizations rely on grants and donations from donors. However, reputable nonprofits with substantial funding often invest a portion of their assets in stocks, bonds, and other securities to bolster their financial position. The aim is to increase the return on current funds by investing the reserve funds. However, there is a need to assess investing alternatives and comprehend your organization’s objectives to avoid making impulsive investments.

If you enjoyed reading this article, please share your comments and suggestions with us at the bottom of this post.

2 Responses