I

Introduction

When donor-advised funds (DAFs) emerged in the 1930s, they were mostly supported by neighbourhood foundations and required rather significant donations. Over time, community foundations and, to a lesser extent, religious institutions remained the main sponsors of these DAFs. Investment firms did, however, commence the establishment of nonprofits to support DAFs in the early 1990s. After Fidelity became a DAF-supporting organisation in 1992, other financial firms soon followed suit.

Presently, donor-advised funds are still outpacing private foundations and other public charities in terms of charitable asset accumulation. No matter the state of the economy, donors who open donor-advised fund accounts are actively using them to support causes and charity organisations that are significant to them. Also, an increasing number of philanthropists are choosing donor-advised funds as their preferred charitable giving vehicle. This is evidenced by the rise in the number of accounts, the rise in contributions to DAFs, and the grantmaking that makes up at least 17% of contributions made in the United States.

Without a doubt, DAF facilitates charitable contributions but is not directly involved in the delivery of charitable goods and services. Due in part to commercial fund sponsors (like Fidelity and Vanguard) that have fewer conventional charity interests, DAFs have grown in popularity in recent years. Many colleges and universities have developed or improved their donor-advised fund offerings. This is especially in response to the growing popularity of this gift option and increased competition for donor relationships from these commercial programs. For educational institutions, DAFs have scaled widely due to the need to increase development efforts among younger alumni and friends.

II

What are Donor-advised Funds

Similar to a charitable investment account, a donor-advised fund, or DAF, is created by a donor with the express intent of aiding charitable causes. By and large, DAFs are among the most talked-about gift instruments available today. In addition, more donors are using them because of their adaptability, affordability, and effectiveness in awarding grants.

Although community foundations were the primary providers of DAFs at first, their popularity has skyrocketed in recent years as more financial services companies have set up DAF programs. Sponsored by eligible 501(c)(3) organisations, DAFs are accounts that look like brokerages. These nonprofit organisations receive donations and deposit them into the sponsored account. While the sponsor is the legal owner of the given funds, they serve as a middleman by giving the DAF donor two significant “advising” rights.

Donating money to a charity through a DAF is remarkably similar to donating money straight from a brokerage account with three key exceptions. Time is the first component. Instead of being paid out of the DAF to a typical charity, the tax implications of a charitable deduction are absorbed when the money enters the DAF. However, trading or reinvesting money in the DAF has no tax repercussions, and all profits and losses go to the final charity beneficiaries.

Convenience comes in second. Giving securities, artwork, or real estate to a DAF before disposing of them makes it simple to avoid capital gains taxation. However, certain smaller donations without a DAF would not be able to do so. Commitment comes in third. Only grants to nonprofit organisations may be taken out of any fund once they are in the DAF. Likewise, direct donations to DAFs are tax-deductible, much like foundation contributions. DAFs are not bound by minimum payout obligations like foundations are.

Nonprofit Qualifications for DAFs

- According to US tax law, a qualifying charity needs to be classified as a 501(c)(3) organisation by the IRS.

- Secondly, donations made by individuals to 501(c)(3) organisations may be deducted from taxable income for those who itemise deductions.

- Appreciated assets like stocks, artwork, and real estate might be donated in addition to money.

Consider presenting a readily valuable item, like stock in a publicly listed corporation. Even more, all DAFs have three fundamental elements or purposes, whether they are Ball State, Wheaton, Fidelity, or the Chicago Community Trust:

- The contributions are received and retained by a 501(c)(3) public charity serving as the host or sponsor.

- A range of investment choices for assets donated by donors, pending requests for grants or distributions

- An administrative and technological competence that gives personnel and donors access to up-to-date data and accounting services.

Furthermore, the donor can advise the sponsor on how to invest the donation. This could be whether the money in the account should be liquidated and transferred to another 501(c)(3) organisation or utilised for other philanthropic purposes. Also, the sponsor, who is the fund’s legal owner, is free to set time and investment limits, although none of these are mandated by law.

III

Critical Statistics on Donor-Advised Funds

In this section, we will consider critical statistics on donor-advised funds to show their impact within the nonprofit sector.

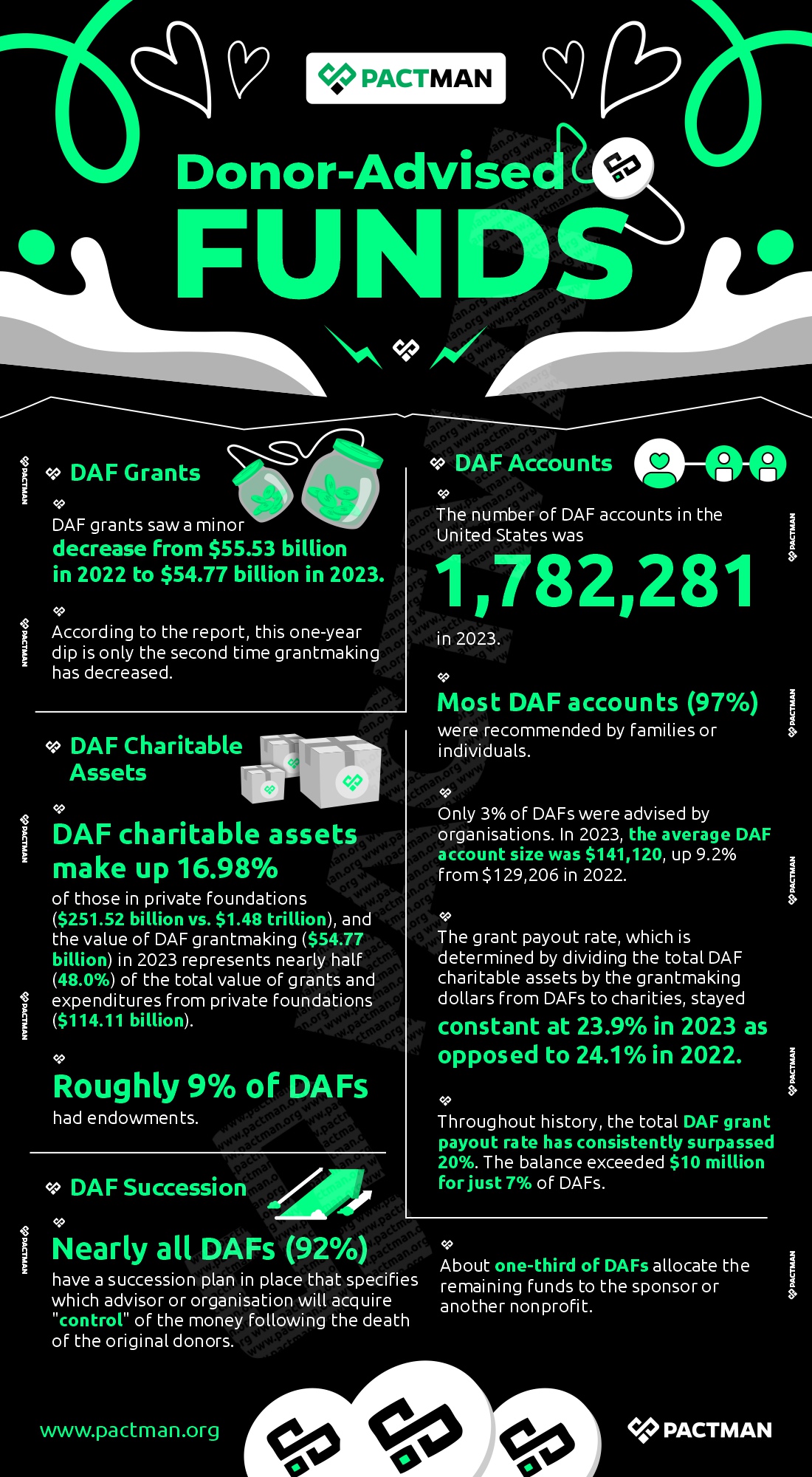

1. DAF Grants

DAF grants saw a minor decrease from $55.53 billion in 2022 to $54.77 billion in 2023. According to the report, this one-year dip is only the second time grantmaking has decreased.

2. DAF Accounts

The number of DAF accounts in the United States was 1,782,281 in 2023. Most DAF accounts (97%) were recommended by families or individuals. Only 3% of DAFs were advised by organisations. In 2023, the average DAF account size was $141,120, up 9.2% from $129,206 in 2022.

The grant payout rate, which is determined by dividing the total DAF charitable assets by the grantmaking dollars from DAFs to charities, stayed constant at 23.9% in 2023 as opposed to 24.1% in 2022. Throughout history, the total DAF grant payout rate has consistently surpassed 20%. The balance exceeded $10 million for just 7% of DAFs.

3. DAF Charitable Assets

DAF charitable assets make up 16.98% of those in private foundations ($251.52 billion vs. $1.48 trillion), and the value of DAF grantmaking ($54.77 billion) in 2023 represents nearly half (48.0%) of the total value of grants and expenditures from private foundations ($114.11 billion). Roughly 9% of DAFs had endowments.

4. DAF Succession

Nearly all DAFs (92%) have a succession plan in place that specifies which advisor or organisation will acquire “control” of the money following the death of the original donors. About one-third of DAFs allocate the remaining funds to the sponsor or another nonprofit.

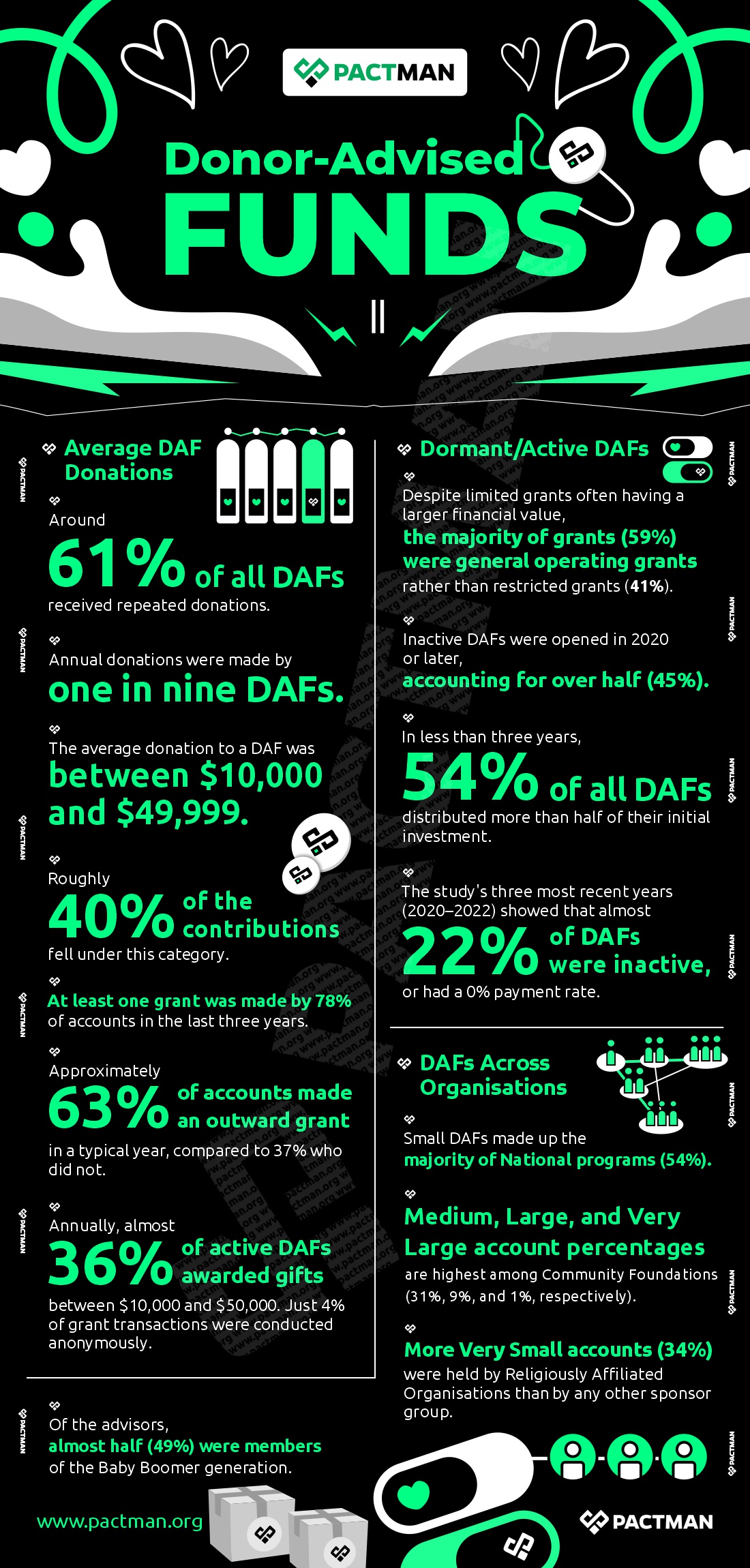

5. Average DAF Donations

Around 61% of all DAFs received repeated donations. Also, annual donations were made by one in nine DAFs. The average donation to a DAF was between $10,000 and $49,999. Roughly 40% of the contributions fell under this category.

For donors, DAFs represent a moderately priced philanthropic vehicle choice. At least one grant was made by 78% of accounts in the last three years. Also, approximately 63% of accounts made an outward grant in a typical year, compared to 37% who did not.

Annually, almost 36% of active DAFs awarded gifts between $10,000 and $50,000. Just 4% of grant transactions were conducted anonymously.

6. Dormant/active DAFs

Despite limited grants often having a larger financial value, the majority of grants (59%) were general operating grants rather than restricted grants (41%). Inactive DAFs were opened in 2020 or later, accounting for over half (45%). In less than three years, 54% of all DAFs distributed more than half of their initial investment. The study’s three most recent years (2020–2022) showed that almost 22% of DAFs were inactive, or had a 0% payment rate.

7. DAFs across organisations

Small DAFs made up the majority of National programs (54%). Medium, Large, and Very Large account percentages are highest among Community Foundations (31%, 9%, and 1%, respectively). More Very Small accounts (34%) were held by Religiously Affiliated Organisations than by any other sponsor group. Of the advisors, almost half (49%) were members of the Baby Boomer generation.

IV

Why Donors Opt for Donor-Advised Funds

To begin with, Donor-Advised Funds offer a lot of the advantages of private foundations without the same documentation and legal constraints. While donations to the DAF are immediately tax-deductible, donors have the option to postpone choosing the final beneficiaries of their contributions. Assets can be distributed over a lifetime or within a few months of their contribution.

Additionally, the reduced deduction restrictions that apply to gifts to private foundations do not apply to contributions to DAFs. Like private foundations, DAFs give donors the option to designate family members as “advisors” to the funds, bringing a new generation of philanthropists into the fold.

Lastly, organisations that decide to offer these programs have access to a wide range of online settings and capabilities that have advanced significantly in recent years. These platforms enhance donor engagement and their overall development initiatives. DAFs’ evident goal is to motivate people to increase their charitable contributions.

Other advantages include the ease with which a DAF can be used for budgetary and charitable donations. However, one’s bank and other brokerage businesses can offer these identical services.

DAFs offer two distinct services: first, they make it simple to deduct appreciated stock from taxes for gifts of any size, and second, they enable contributions made now to be saved for the future. Therefore, the extra charitable donations made possible by DAFs are to their advantage.

In conclusion, DAFs cannot be beneficial if the taxpayer only transfers assets to reduce taxes and makes no further charitable contributions. On the other hand, the DAF may be beneficial if donors

i) contribute more money on the dates they had intended,

ii) give what they had planned earlier,

iii) give more in present value terms than they had anticipated, or

iv) any combination of those above.

V

Top DAF Platforms Globally

In this section, we will consider the top platforms that provide reliable donor-advised fund services.

1. Vanguard Charitable

Vanguard Charitable is one of the top nonprofits in the United States. Also, the platform sponsors donor-advised funds, which are a tax-efficient means to accumulate, consolidate, and donate assets to charitable causes. For the most part, donors can give in a variety of ways using the organisation’s philanthropic accounts, which ultimately enable them to have a wider humanitarian impact.

In 1997, Vanguard established Vanguard Charitable as a separate 501(c)(3) corporation. Despite being distinct organisations, Vanguard Charitable shares many of Vanguard’s core beliefs and investment philosophies, such as its dedication to cost-effectiveness, transparency, and diversity. Also, the organisation is a strong proponent of a long-term, strategic charitable plan that maximises impact while minimising expenses.

Vanguard’s goal is clear: raising generosity and gradually expanding impact. According to the organisation, reaching its goals requires helping its clients attain theirs first. A new planning suite, a progress tracker, quicker electronic grants, and more investment options are now available to Vanguard Charitable donors.

2. Fidelity Charitable (FC)

Fidelity Charitable is a public charity under section 501(c)(3). Through the Giving Account which is a donor-advised fund, FC assists donors in maximising their generosity. The organisation was founded in 1991 and is one of the largest grantmakers in the country.

For a wide variety of donors, the Giving Account simplifies the process of strategic giving by enabling donors to make contributions of various asset types and organise their contributions more methodically. FC currently works with over 350,000 donors. Donors can look up charities to support by name or by tax ID number.

Also, since its inception, the organisation has disbursed $100 billion in donor-recommended awards to over 433,000 organisations in all U.S. states and abroad. The nation’s largest donor-advised fund program is sponsored by Fidelity Charitable.

3. National Philanthropic Trust (NPT)

The National Philanthropic Trust assists donors in fulfilling their charitable objectives. NPT is one of the biggest grantmaking organisations in the US and a pioneer in donor-advised funds (DAFs). As a public charity, NPT is committed to helping foundations, financial institutions, and donors achieve their charitable goals by offering philanthropic expertise.

One of the most widely used philanthropic giving vehicles is a donor-advised fund (DAF), and NPT is one of the biggest independent national providers of DAFs. The organisation collaborates with foundations, financial institutions, advisors, and donors. To free up more time for accomplishing charitable objectives, NPT assists with the administrative aspects of donations.

The organisation was established in 1996. Since then, it has managed $49.8 billion in philanthropic assets and raised over $73.4 billion in charitable contributions. To date, it has awarded over 870,000 donations to nonprofits worldwide, totalling over $34.6 billion. As one of America’s biggest grantmaking organisations, NPT’s goal is to make society more philanthropic.

4. DAFgiving360

DAFgiving360 seeks to boost philanthropic contributions in the United States. To do this, the organisation offers a straightforward and tax-smart giving solution. This is in the form of a donor-advised fund (DAF) account together with associated philanthropic resources and advice that enable donors to integrate planning into their daily life.

Over $40 billion has been donated to over 270,000 organisations since DAFgiving360TM was established in 1999 as a separate 501(c)(3) public charity.

By and large, three efficient methods are available to donors to support causes, communities, and emergencies worldwide:

1.) Donate to American charities that operate abroad.

2.) Donate via middlemen that allow direct donations to global nonprofit organisations.

3. Make direct contributions to eligible international charities via its Global Giving Program.

According to DAFgiving360, its donors gave more than $7.7 billion to charity in 2024, a 25% increase ($1.5 billion) from the previous year.

5. American Endowment Foundation (AEF)

The American Endowment Foundation is one of the biggest independent donor-advised fund sponsors in the country. Founded in 1993, AEF stands out for its people-driven culture that produces a remarkable client experience.

All in all, AEF is a mission-driven corporation dedicated to growing philanthropy. By collaborating with financial services firms and advisors, AEF broadens its philanthropic reach. This makes it possible for more donors to make a big difference in charity. Also, to boost the amount given to donors’ organisations and causes, the organisation engages with them through their financial advisors to set up and manage AEF donor-advised fund accounts. This strategy enables the platform to concentrate entirely on its core competency, which is providing the greatest possible client experience.

Furthermore, AEF provides an objective method of giving as a cause-neutral sponsor, which gives it greater latitude in suggesting 501(c)3 nonprofits for funding. The donor can choose where to recommend grant funds. Additionally, by collaborating with donors, corporations, and financial advisors, AEF provides a people-driven approach to philanthropy.

Conclusion

In summary, Donor-advised Funds allow for the speedy distribution of donations and the temporary holding of cash, which can be helpful for year-end planning. However, the speed at which donations are used for charitable purposes is still a worry for both foundations and DAFs. Determining the amount of additional non-cash giving that occurs through DAFs is the task at hand.

DAFs and foundations are quite similar, although there are significant differences, such as legal requirements. DAFs are significant because they facilitate the use of non-cash assets for regular charitable contributions.

As an example, charities frequently have a policy of only accepting non-cash gifts of stocks if the value surpasses a minimum threshold established by the charity, which is typically several thousand dollars. DAFs would therefore have no effect on gifts beyond this amount. Lesser gifts might be financed with appreciated assets through DAFs, but not otherwise.