I

Introduction

The budget is an important component of any organisation’s strategy. Essentially, budget management can be leveraged as a strategy that provides the adaptability required to successfully and efficiently accomplish your nonprofit’s objectives. Every year, the budgeting process can become more efficient through the documentation of budget assumptions and modifications.

To begin with, budgets for capital and operations should be part of any organisation’s financial plan. The operating budget summarises the organisation’s anticipated financial activities for the year, including the sources of revenue and operating expenses. The capital budget might contain initiatives that can impact operations for a long time.

Oftentimes, maintaining and enhancing operations can be a constant struggle for nonprofit organisations, particularly in the current uncertain economic climate. Hence, nonprofits must always aim for sustainability. A carefully thought-out budget management plan will prioritise the organisation’s main aims and objectives while offering programming and financial flexibility, which are essential components of optimal sustainability.

All in all, the theories and practicalities of budgeting are presented in this guide for nonprofit organisations.

II

Time Factor in Budget Management and Planning

A budget ought to be created well in advance as a planning tool. Even more, there should be ample time to present the budget to the board of directors for approval and to make any necessary revisions. Although it may be challenging to identify constructive criticism after your diligent budget preparation, you must be prepared to start over.

To begin with, don’t put the budget away in a closet once it has been created and approved. Everyone must take the budget seriously if it is to be beneficial and successful. Regularly (monthly or quarterly), the budget and experience should be compared to enable board members and executive officers to assess if the organisation’s objectives, established by the budget are being met.

Also, it is ideal for any financial reporting presentation to include a comparison between actual and budgeted revenue and expenses. The budgeting committee can use the variance to compare its progress and decide what steps to take for the rest of the budget year. Additionally, it enables the development of superior future planning skills.

III

Critical Statistics on Budget Management

This section will consider critical statistics on budget management for organisations.

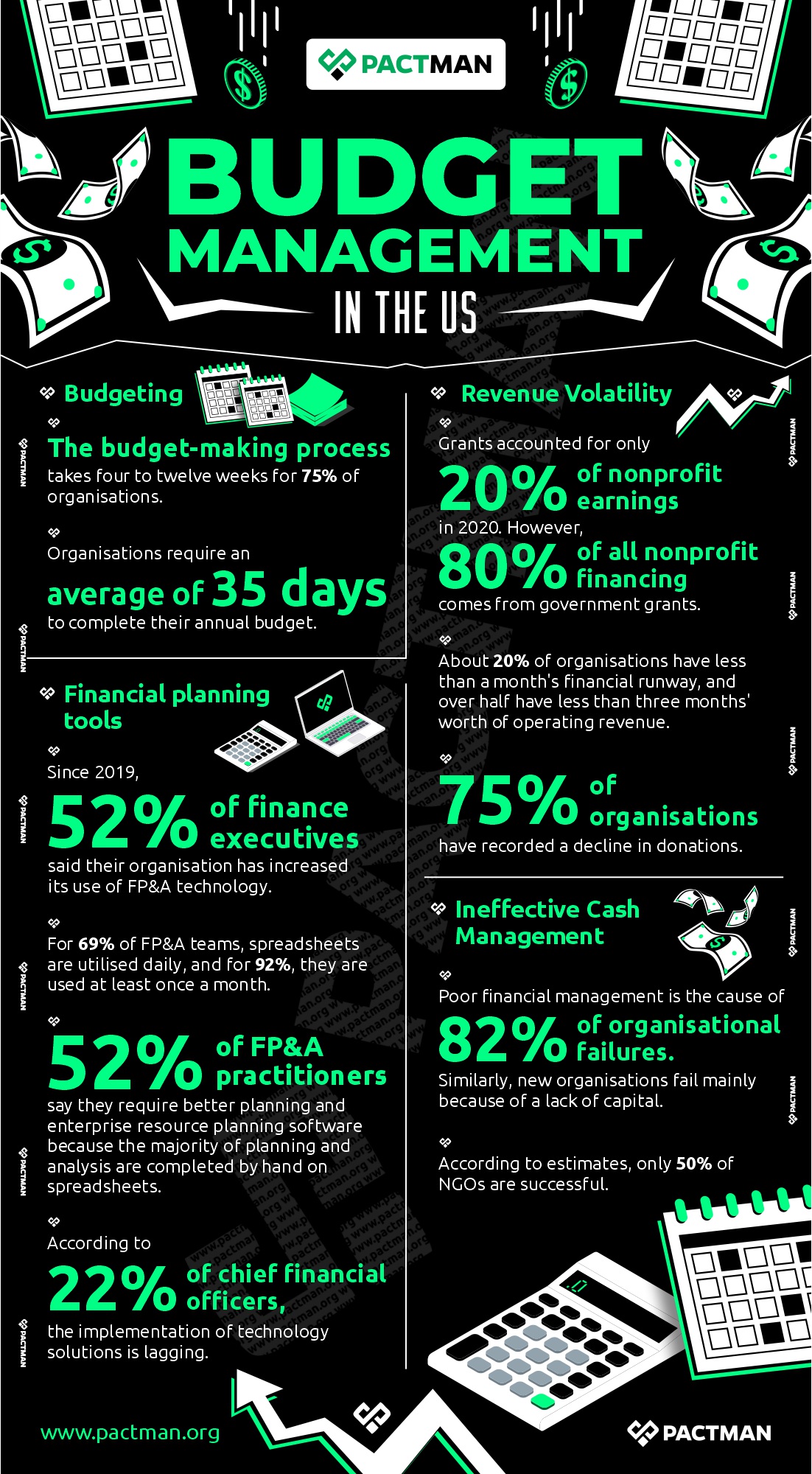

a. Budgeting

The budget-making process takes four to twelve weeks for 75% of organisations. Also, organisations require an average of 35 days to complete their annual budget.

b. Financial planning tools

Since 2019, 52% of finance executives said their organisation has increased its use of FP&A technology. For 69% of FP&A teams, spreadsheets are utilised daily, and 92% are used at least once a month.

52% of FP&A practitioners say they require better planning and enterprise resource planning software because the majority of planning and analysis are completed by hand on spreadsheets. According to 22% of chief financial officers, the implementation of technology solutions is lagging.

c. Revenue Volatility

Grants accounted for only 20% of nonprofit earnings in 2020. However, 80% of all nonprofit financing comes from government grants. Additionally, about 20% of organisations have less than a month’s financial runway, and over half have less than three months’ worth of operating revenue. 75% of organisations have recorded a decline in donations.

d. Project Planning

According to a 2018 global survey by the Project Management Institute (PMI), organisations around the world lose $1 million every 20 seconds as a result of poor project management techniques that result in ineffective organisational plan implementation. Altogether, this amounts to about $2 trillion in waste annually.

Additionally, it has been noted that 43% of projects run over budget, 48% are not finished on schedule, and 31% of initiatives fall short of their objectives. The National Centre for Charitable Statistics estimates that within a decade, almost 30% of NGOs will cease operations. Additionally, 75% of organisations under-plan, which leaves them unprepared for unanticipated events since they fail to account for potential future scenarios.

e. Ineffective Cash Management

Poor financial management is the cause of 82% of organisational failures. Similarly, the main reason why new organisations fail is a lack of capital. According to estimates, only 50% of NGOs are successful.

f. Revenue Planning

According to the Charities Review Council, program costs should account for 65% of donations, with no more than 35% going to fundraising and administration combined. Additionally, if a charity’s program spending is 75% or higher, it is seen as being extremely efficient.

g. Inadequate budgeting

Roughly 78% of financial decision-makers admit that their organisation makes some assumptions while making planning decisions. When combined, these findings suggest that financial planners generally struggle to implement data-driven decision-making.

76% of FP&A practitioners believe that their performance is being hindered by an excessive number of priorities.

IV

Setting Nonprofit Budget Priorities and Realities

To begin this process, the budget committee must examine the reasonable revenue forecasts. Even more, it is crucial to analyse every available revenue stream to identify potential future improvements. Typical revenue sources include public donations, grants, endowment or restricted funds income, ticket sales, auction earnings, and fees for goods and services.

Also, a comprehensive and precise database of contributors can be useful when projecting expected donor revenues from general contributions, pledges, and grants. Records can be kept in a basic spreadsheet or with a CRM module in more complex accounting software.

Typically, income and costs are linked, as in the case of fundraising initiatives that yield income at a specific cost. Excess revenue over expenses can cover the organisation’s other costs, such as administrative costs and nonprofit programs. However, the NPO should neglect any expenses, particularly when determining extra revenue to allocate to other items in the budget.

It’s crucial to check the nonprofit bylaws for clauses that can put an excessive amount of strain on the organisation. This includes the demand that an annual audit be conducted by a hired expert rather than a selfless volunteer.

Additionally, familiarise yourself with the various expenses that the firm must expect throughout the fiscal year:

- Direct costs are associated with a particular program or initiative.

- Long after the budgetary year is over, the organisation benefits from capital expenditures for things like real estate or automobiles.

- Overhead or indirect expenses might not directly relate to a project, but they can be required to finish it.

In summary, nonprofits should budget for and report these in-kind contributions when they can be sufficiently documented. However, they might not have a financial impact because they are recognised as income when received and as an expense when used, usually in the same period.

a. Grant funding

Certain programs are fully funded by grants. When a grant application is submitted, the budgets for particular grant programs are created. In addition to asking for the program’s specific expenses, these budgets should also account for the internal expenses of running the program if the grant is given.

The secondary expenditures and incidentals, which can quickly mount up and overwhelm a well-planned effort should be taken into account in the planning process.

Also, the proposal can include the cost of grant management. Grant programs should never be rejected because they do not cover all indirect costs. All in all, budgeting for initiatives that will be funded by unrestricted grants and general contributions requires some flexibility to account for unforeseen expenses.

b. Cash Flow Budget

Other budget report formats, in addition to the comparative revenue statement, will guarantee an organisation functions efficiently. Also, a cash flow budget is crucial for nonprofits. This is the monthly breakdown of revenues and expenses to ensure funds are available when needed.

An organisation will not be able to pay its expenses unless it has accumulated a sizable cash surplus. Also, this holds if it anticipates all of its revenue in the final three months of the year and all of its expenses in the first three months. Hence, it is best to plan for your nonprofit’s cash flows, revenues, and expenses.

c. Capital Expenditures Budget — Bought or Received

Furthermore, an organisation’s financial situation is reflected in its capital budget. Assets that are purchased with more longer life span than the present are referred to as capital expenditure. The majority of organisations have a different procedure for authorising funds for capital assets.

Oftentimes, an NPO’s financial success can be greatly impacted by capital expenditures, which might be quite high. The capital expenditures budget covers Information technology maintenance and upgrades, staff professional development, and depreciable in-kind donations. Small organisations frequently borrow funds, have board members use their assets to fund the organisation, or receive non-cash donations.

V

Budget Management Priorities for Nonprofits

This section will consider various budget management practices that nonprofits can leverage for efficiency and transparency.

a. In-kind contributions

All things considered, gifts are examples of in-kind contributions. Conversely, the value of the objects for the organisation’s records must be estimated. The purchase price, depreciation, or residual value of the gift may occasionally be provided by the donor.

Also, donors should not get fair market value (FMV) assessments from the organisation. Likewise, the organisation should create an internal Gift Acceptance Policy (GAP) on how to record the donations if no valuations are given. By establishing a gift acceptance policy, the board can establish the rules and regulations for managing various donations, getting rid of dangerous or contentious contributions, and meeting the legal requirements for gift registration and recognition.

Certain given goods, like stock or a car, for instance, need a title transfer, which is documented with regional or federal agencies like the U.S. Securities and Exchange Commission (www.sec.gov) or the Virginia Department of Motor Vehicles (www.dmv.state.va.us). Ensure that this title transfer is completed in a timely and orderly way.

Furthermore, certain gifts entail additional costs and duties for the organisation. Hence, before receiving a gift, you should think about the following:

- Can you protect this asset?

- Does it require insurance?

- Is a secure deposit box necessary?

- How much does this asset cost to operate each year?

- Is there maintenance or replacement parts needed for the gift?

⚠️ Caution

At this point, it is necessary to create and keep a master list of all assets and their locations in a secure central location. This is especially crucial in a situation where they are kept on property that is not owned by the organisation. Also, the organisation should have a GAP and an acceptance committee to ensure that every donation supports the nonprofit’s goals.

Even more, additional gifts require budgeting and accounting. Could your nonprofit cover the gap in cash donations to pay the rent if it no longer obtains a location free of charge? The easiest way to respond to this question is to document the previous gift’s value. A Reserve Study is necessary for these funds to forecast future expenses and their dates.

b. Restricted Grants

Secondly, it is necessary to budget for restricted funding beforehand. A thorough investigation of the grantor will enable the nonprofit to understand the grantor’s expectations. Also, there may be numerous conditions attached to grants.

In addition to the donor, the nonprofit should try to speak with another organisation that has already been awarded a grant of this kind about the conditions.

The grant or gift’s limitations must be precisely stated and understood by all parties. Furthermore, a jointly signed agreement that outlines the financing amount, the expected funding date, and the constraints are often prepared between NPOs and the grantor. The nonprofit organisation should include a contingency plan in the agreement in case the grant or contribution requirements are not met.

By and large, the documentation may permit the grant to be reclassified, redirected, or refunded in this situation. NPOs should make sure that their GAP policy includes instructions for accepting restricted gifts. This ensures that donors and fundraisers are aware of the policy and consent to enable flexibility in specific circumstances.

c. Budget Changes

Is it possible to alter budgets? Yes! When expectations are not fulfilled, budgets will need to be adjusted. Likewise, when an emergency or opportunity presents itself, a nonprofit should be able to manage the change systematically rather than abandoning a strong budget plan.

By all means, the organisation can assess whether the overall budget is sound or whether actual events necessitate adopting a new budget by regularly reviewing deviations and projections. Also, bylaws should be reviewed for instructions on how to modify an adopted budget if needed. Typically, minimal alterations can be made by the executive officers, and changes exceeding a specified threshold should receive approval from the board of directors.

If a planned donation does not come through, you have a few options. The most obvious is to look for more funding sources. Forthwith, the accounting system’s CRM feature can assist in locating donors who are willing to contribute to the particular deficit. Afterwards, you can reduce spending. Also, it is possible to reschedule a program that was originally planned to start in a particular quarter, which would also allow for the relocation of the program’s costs. The budget as well as the present cash and financial situation should be considered while making any of the aforementioned options.

Conclusion

As can be seen, the goal of a budget is not to be correct. Rather, nonprofit organisations use budgeting to ensure their plans and realistic financial targets for the next year are reflected. A nonprofit budget serves the function of giving your organisation a road map to help prepare, make decisions, and modify plans when things don’t go as expected. By and large, this ensures that you can continue on your current course throughout the year. Being a strategic and financial management tool, the budget is arguably the most crucial financial document for nonprofit organisations.