I

Introduction

Although profitability is not the primary goal of most nonprofit organizations: unlike for-profit businesses, nonprofits do not seek to maximize revenues. Nonprofits need efficiency in handling resources for multiple reasons including (for grants and fundraising) showing to Foundations and Donors that they are viable organizations. Nonprofits therefore must understand the basics of financial management to guide them in the use of their financial resources.

Also, in the nonprofit world, it might be challenging to earn more cash than expenses. As a result, there is a need for organizations to be concerned with the management and security of financial resources. An organization should be aware of the danger of financial loss and be willing to adopt necessary precautions.

II

What is financial management?

Financial management is the practice of effectively handling funds to accomplish corporate objectives. Making wise financial choices and decisions requires good planning to ensure that funds are used appropriately. Likewise, financial management allows an organization to adopt managerial practices in its financial structure.

A financial strategy should consider both short-term and long-term goals. Also, when making financing decisions, organizations must determine the best ways to raise funds from both short-term and long-term sources. The genuine value of effective financial management stems from its capacity to equip employees with the resources and funds needed to carry out the organization’s goals.

To begin with, effective financial management demands practical understanding and technical skills. This applies to both new organizations as well as established nonprofits seeking to increase efficiency. By and large, good financial management practices enable an organization to successfully carry out its operations and honestly handle its resources.

III

Financial Statistics Worth Considering

Nonprofit organizations have their unique budgeting and financial management concerns that must be carefully evaluated based on the organization’s structure. In this section, we will consider some of the most notable financial management statistics worth considering.

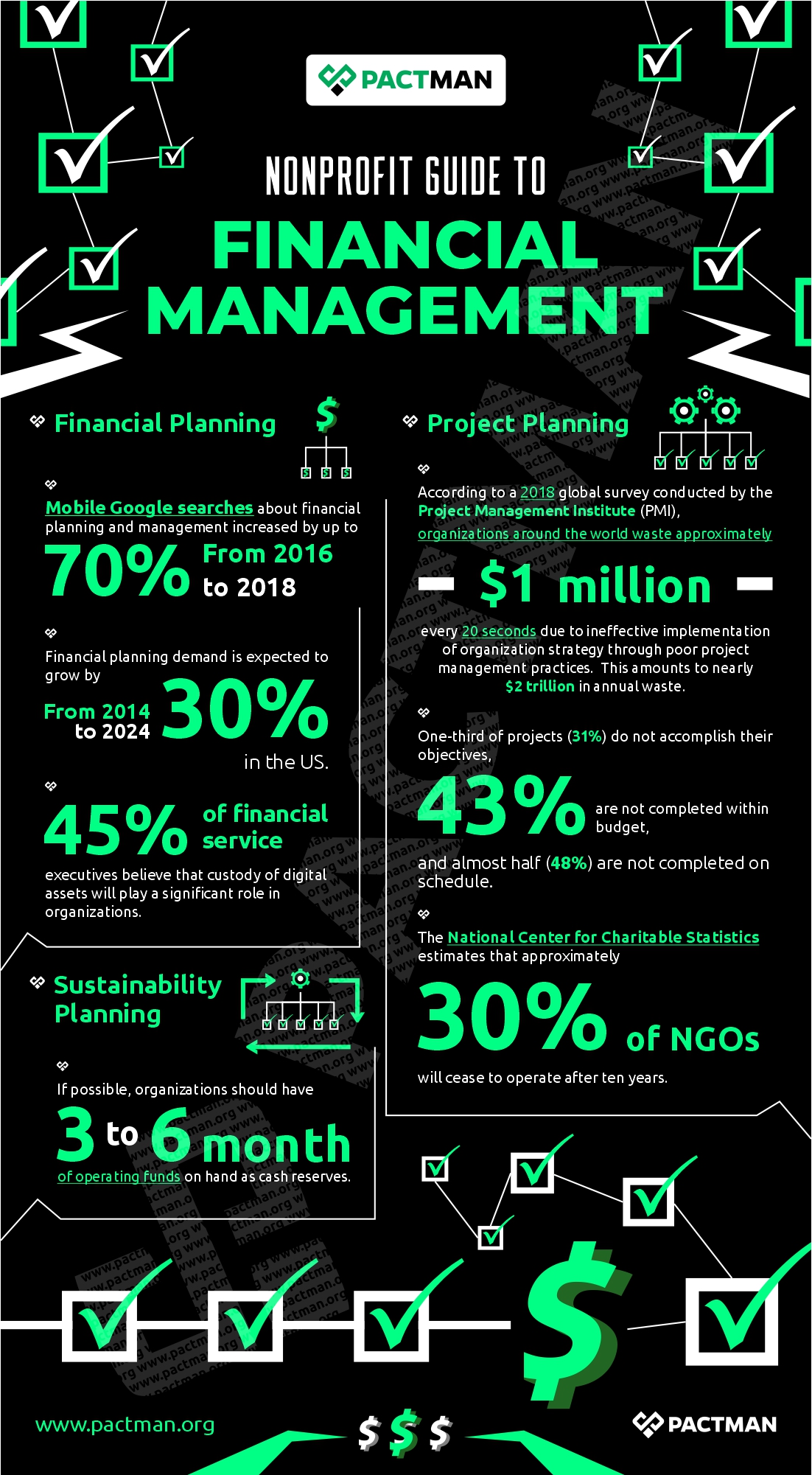

Financial Planning

Mobile Google searches on financial planning and management were up 70% from 2016 to 2018. Financial planning demand is expected to grow by 30% from 2014 to 2024 in the US. Likewise, 45% of financial service executives believe that custody of digital assets will play a significant role in organizations.

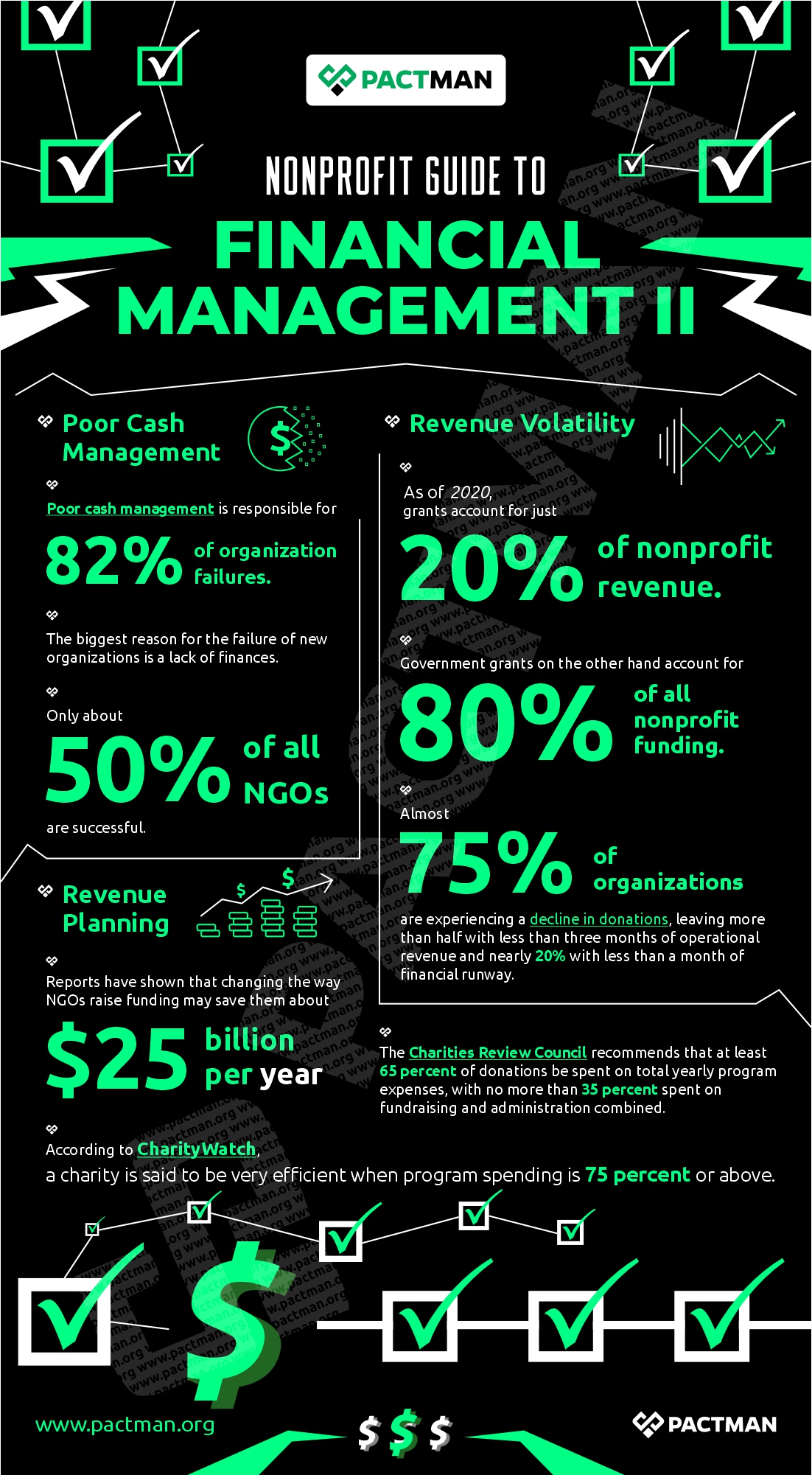

Poor Cash Management

Poor cash management is responsible for 82% of organization failures. Similarly, the biggest reason for the failure of new organizations is a lack of finances. As a result, only about 50% of all NGOs are successful.

Revenue Volatility

As of 2020, grants account for just 20% of nonprofit revenue. Government grants on the other hand account for 80% of all nonprofit funding. In addition, almost 75% of organizations are experiencing a decline in donations, leaving more than half with less than three months of operational revenue and nearly 20% with less than a month of financial runway.

Project Planning

According to a 2018 global survey conducted by the Project Management Institute (PMI), organizations around the world waste approximately $1 million every 20 seconds due to ineffective implementation of organization strategy through poor project management practices. This amounts to nearly $2 trillion in annual waste.

Also, one-third of projects (31%) do not accomplish their objectives, 43 percent are not completed within budget, and almost half (48%) are not completed on schedule. The National Center for Charitable Statistics estimates that approximately 30% of NGOs will cease to operate after ten years.

Revenue Planning

Reports have shown that changing the way NGOs raise funding may save them about $25 billion per year. The Charities Review Council recommends that at least 65 percent of donations be spent on total yearly program expenses, with no more than 35 percent spent on fundraising and administration combined. According to CharityWatch, a charity is said to be very efficient when program spending is 75 percent or above.

Sustainability Planning

If possible, organizations should have 3 to 6 months of operating funds on hand as cash reserves.

IV

What are the major management risks being faced by nonprofits?

Nonprofits rely on the support of the board of directors and donors to which they are directly accountable. Also, nonprofits require powerful and proactive boards of directors to offer supervision in an economy that expects higher organizational efficiency and in a society that demands increased accountability. Hence, board members are required to develop effective measures and control systems. However, there are various organizational risks that the majority of nonprofits continue to grapple with. We will consider a few of them.

a. Knowledge Gaps

Grantmakers and nonprofits alike have a fundamental misunderstanding about the nature of money in the sector. Most nonprofit staff employees are chosen for their expertise in a specific field rather than their understanding of charity finance. Likewise, a fundamental issue confronting the sector is a lack of shared understanding and clarity regarding the forms of capital that NGOs require the most.

In addition, most NGOs lack the awareness of what it truly costs to deliver services or achieve their growth goals. This continues to constitute a major impediment to organizations as they are unable to receive the most needful form of support from grantmakers.

b. Fundraising

The financial hazards that come with fundraising are twofold and extend beyond the theft of funds raised. First, an organization must safeguard itself from unethical fundraising. Many nonprofits have uncovered phony organizations seeking cash on their behalf for which they are not aware. Now more than ever, there is a need for nonprofits to be cautious about the misuse of their name and emblem, especially when it comes to fundraising. Also, a nonprofit must act swiftly as soon as it discovers that a person is using its name and logo without permission. In addition, an organization must carefully examine its sponsors and partners to avoid media disasters.

c. Limited Supervision

Oftentimes, managers lack the time to balance the accounts or anticipate future obligations. At the same time, managers may not be able to make sensible financial judgments if they lack the time to research various options. Some organizations struggle with tax-exempt status or lack the knowledge to manage funds. There is also the possibility of fraud and misappropriation of funds.

In addition, most nonprofits have a low number of employees. As a result, available employees wear several hats in a typical day’s work. This can constitute a difficulty for non-profit accountants. However, resolving these various limitations may improve an organization’s financial stability.

d. Unstable revenue

Another concern is the volatility of revenue cycles in many non-profit organizations. This constitutes a challenge in creating realistic budgeting. Because of the inherent unpredictability and inconsistency of such funds sources, organizations that rely on grants or a limited number of significant contributors are particularly vulnerable.

Unstable revenue streams result in several issues, including service delays and budgeting and financial planning difficulties. Many of the public services offered by nonprofit organizations have traditionally been sponsored by government grants and fees.

Now more than ever, nonprofits must seek ways to achieve a balance between the frequent contradictory issues of revenue growth and revenue stability.

To meet the growing demand for services, NGOs must become more entrepreneurial in terms of generating adequate finances to carry out their missions and objectives. Thus, revenue development is frequently regarded as one of the key aims of nonprofit financial management.

V

Effective financial management tips for nonprofits

Nonprofits, unlike for-profit organizations, cannot deliver all of their financial resources via the provision of goods and services. Oftentimes, they may need to rely on funds from other sources, such as states, foundations, or individual donations. This also comes with its consequences when trying to resolve financial management practices.

First of all, a nonprofit’s annual revenue increase should be sufficient to sustain existing operations in future years. Likewise, nonprofit organizations that intend to boost their future service levels must also increase their revenue.

The Minnesota Council of Nonprofits outlines nineteen effective functions and activities that organizations can adopt to ensure financial sustainability. However, we will consider just ten of these management practices that apply to our subject area.

- When reviewing and approving a complete written budget of revenues and expenditures, the board should have a good understanding of the deductions behind the budget’s development.

- Individuals in charge of an organization’s financial reporting should compile and deliver financial reports to the board at least bimonthly. Also, financial reporting should be consistent, timely, and accurate and ought to be compared to the organization’s budget.

- To the greatest extent practicable, a nonprofit should establish a separation of financial duties for effective checks and balances and to prevent theft, fraud, or erroneous reporting. The board should adopt this internal control system and relay it to the organization’s financial and human resources.

- Nonprofit organizations should have defined financial procedures and relevant financial management tools in place to record income and govern key expenses and asset utilization, such as payroll, expense reimbursements, investments, leases, travel, debt use, contracts, consultants, and cash and in-kind contributions.

- Nonprofit organizations that obtain funds from government bodies should be cautious when negotiating contract terms to ensure that payment amounts, conditions, and reporting requirements are in line with the organization’s objective and the interests of the people being served.

- Nonprofits should review their risks regularly, take appropriate steps to mitigate them and obtain appropriate types and levels of insurance to prudently manage their liabilities.

- A nonprofit’s board should use market data of comparable jobs to determine the executive director’s salary and stay current on compensation levels for other key workers.

- The board of directors of a nonprofit organization should firmly ban financial loans to board members, the executive director, and other significant employees.

- Board members and key personnel should grasp how to read and evaluate financial accounts, as well as the limitations on the use of restricted funds in nonprofit organizations and the function of debt.

- The board treasurer should take the lead in assisting the board in understanding its financial management responsibilities. The treasurer should also enlighten board members about the organization’s present financial situation, projected revenue, and the need to make timely expenditure adjustments to keep the organization healthy.

VI

How to start financial management

Money management is at the heart of all key organizational decisions. As a result, competent financial management spans sectors, industries, and businesses, making it one of the most crucial tasks of corporate executives and directors. Likewise, financial performance directly impacts financial sustainability, which in turn influences an organization’s current and future success. Hence, to thrive efficiently, nonprofit managers must closely monitor and supervise their organization’s finances and financial management strategies.

In this section, we will consider how nonprofits can begin financial management planning.

a. Make a budget for effective financial management

Your organization’s budget is one of the most obvious and crucial aspects of nonprofit financial management. The goal is to plan your organization’s various spending for the year. Hence, it is best to create and plan your budget during the start of the year, but you will need to make minor adjustments subsequently as financial circumstances change. In general, it is best to revise your annual budget on a quarterly or semi-annual basis. Even the greatest planning can go awry at times. Hence, to stay on track, ensure you frequently review your organization’s finances.

b. Prioritize financial management statements and reports

Pulling reports and statements from your statement of accounts to describe your organization’s use of cash is another critical component of your nonprofit’s financial management activities. Since these reports contain critical information, they can provide insights into the financial health of your nonprofit.

Afterward, your organization’s accountant should assemble and review these statements to decide on the next action. Remember, these are the same statements that your nonprofit auditor will look through when performing a financial audit.

Your income statement is also known as your nonprofit statement of activities. It enables your organization to compare revenue to spending over time by categorizing your various expenditures and funds. This statement is divided into three components:

Revenue. These are obtained from contributions, fees, dues, investment income, and funding.

Expenses. Your organization’s core programs, fundraising efforts, and operating expenses should be within the expenses section.

Net assets. Finally, the net assets part of your financial statement can help show the difference between your income and expenses.

c. Hold stakeholders accountable

Your board of directors, executive director, and finance team are all significant stakeholders in your financial management processes. To ensure responsible management practices, leaders must be accountable in carrying out their duties.

Who is in charge of ensuring that your nonprofit’s financial management systems are effective? Answering these questions is a great way to know the right people responsible for managing funds.

By and large, it is best to have more than one person managing financial operations. This helps to ensure a more effective and healthy management system. Likewise, good financial management will necessitate the participation of your entire work team.

Your board of directors’ primary responsibility is to provide organizational oversight. When it comes to financial management, your nonprofit board will have to evaluate and approve various crucial financial documents for your organization. This includes annual audit, annual budget, and IRS Form 990.

Also, your nonprofit finance team is the on-the-ground team responsible for ensuring that your organization’s financial management systems are effective. They generate financial reports and explain the findings to the executive director. This group also comprises the accounting and bookkeeping staff.

d. Diversify your funding sources

Diversifying your funding helps to stabilize your nonprofit’s finances. Here are some methods you can use to diversify your organization’s income.

-

Determine how much of your income comes from each of your present funding sources

To begin, check to see if there are better ways to increase your funding sources. Consider the existing services you provide. Is there any way you could charge for those services?

Also, examine the organization’s operations that can be run tax-free with your other services. You could, for example, operate a secondhand shop or rent out space for third-party group activities. Consider various revenue options that align with your nonprofit’s missions and objectives.

-

Concentrate on long-term funding

Donors prefer to give more money over time as their relationships with your organization grow deeper. Furthermore, acquiring new supporters is more expensive than retaining existing ones. As a result, plan effective ways to cut your fundraising costs by retaining and sustaining current donors and supporters.

Donor retention can help you develop a more sustainable fundraising base. The average donor retention percentage still stands at a recurring 45%, according to Bloomerang’s donor retention guide. This presents an opportunity for your organization to go above and beyond your current level.

-

Invest in non-profit finance software

While nonprofits rely on the generosity of their supporters and grantors to operate, for-profits sell goods and services to generate cash. As a result, organizations must manage the constraints imposed by their not-so-flexible financing sources. Also, nonprofits can effectively manage finances by adopting fund accounting techniques.

Fund accounting software can greatly help to manage nonprofit funds while keeping the accounting system orderly. Quickbooks, for example, is a solution also used by charitable organizations for bookkeeping.

Effective nonprofit financial management entails more than just putting in place the proper procedures and producing the finest reports. It also stems from value-based decisions that can help shape the future of an organization.

Conclusion

Nonprofit organizations have their unique budgeting and financial management concerns that must be carefully evaluated in accordance with their structure. Although these entities exist to address social concerns and not to make a profit, they nevertheless cannot function without financial resources. Hence, there is a need for efficient use of finances to execute a nonprofit’s objective. Also, it is best to develop clear policies and practices to routinely assess the use of funds.

In addition, nonprofit organizations should strive to establish or retain an industry model that is dependable, adaptable, and enables the effective use of resources to achieve their various objective.

If you enjoyed this article, and have any comments/questions, please let us know below!

7 Responses