I

Introduction

The term ‘nonprofit business’ is certainly not a common phrase. This is largely because we all have the preconceived notion that a nonprofit organization does not take part in business activities. So the staggering question is: can a nonprofit organization run businesses or trades to earn cash and also support their philanthropic endeavors? To answer briefly, Yes.

However, two main issues arise when a nonprofit runs a trade or business. First off, is the business’s revenue taxable? Second, if the business operations grow too large, would the nonprofit’s tax-exempt status be at risk of being revoked?

It can be challenging for nonprofit organizations to generate enough revenue to stay afloat. Even more, the global financial crisis makes it extremely harder to generate income. As a result, many nonprofits struggle to gather enough funds to support their ongoing operations and achieve their goals. The best option in this case can be to set up a nonprofit business.

In this article, we will outline what a nonprofit business plan entails and the inherent benefits for NGOs.

II

How Do Founders of Nonprofit Companies Make Money?

According to IRS regulations, a non-profit’s earnings may not “inure to the benefit of any shareholder or individual.” This tends to elicit the question of how the founders are paid as well as the staff for the work they do. It is rather simple.

The IRS makes a distinction between a benefit and a pay for labor performed. Founders of nonprofit organizations might pay themselves a reasonable wage for the job they do managing the business. They can also pay part-time and full-time employees for the tasks they complete. It is the duty of the nonprofit management (appointed by the nonprofit board) or nonprofit board to pay the founder. Although they frequently put in enormous hours, they earn far less than CEOs at for-profit companies. It is however fair for them to get compensation for the services they perform as managing a non-profit may be their sole source of income.

The fact that there is no set limit on how much non-profit owners may be paid is one of the factors that can cause uncertainty surrounding the subject of compensation. However, companies that overpay CEOs or staff may face penalties from the IRS.

Generally, the organization’s gross revenues are what is ultimately used to pay the non-profit’s founders and workers. Also, certain wages are included as part of the organization’s operating expenses.

III

Should Nonprofits Venture into Profit Making?

In most nonprofits, earned revenue only makes up a small portion of income. And very few nonprofit businesses are profitable.

Naturally, there is nothing new about earned-income ventures in the nonprofit sector. For example, NGOs have long managed universities, hospitals, and theatrical companies. Revenue-generating initiatives are now being launched or contemplated in almost every nonprofit sector, from human services to housing to the environment. And this is not just limited to education, healthcare, and the arts.

While some of the new businesses are entirely independent of the organizations’ main operations, others get their revenue from goods or services offered as part of their current programs. However, practically all business ventures include the organization entering uncharted commercial seas.

Even under ideal conditions, starting a business is challenging. Nonprofits face much greater challenges as a business project can distract the organization from its primary objectives.

Hence, a crucial question nonprofit directors must consider is: does this project advance our organization’s primary goal? Even if a venture never makes a profit, it may be appealing if the business advances the objective of the nonprofit organization while allowing it to recover some of its costs.

Several for-profit businesses complement nonprofit organizations’ aims. Likewise, the nonprofit sector is brought back to its core values when earned income opportunities are evaluated in light of its mission. If the most promising mission-based initiatives can bring in some revenue, then, of course, they should.

In addition, the majority of grants are modest, transient, and limited in scope. The fact that earned income is unconditional makes it valuable. It can be used for whatever the nonprofit’s management determines to be most important. This includes operating support for already successful initiatives and “overhead” like managerial talent and development that philanthropic and public funds commonly do not cover.

IV

What is a Nonprofit Business Plan?

A nonprofit business plan acts as a road map or compass for the entire organization. In a nutshell, it describes the non-profit’s aims and objectives, organizational structure, marketing, financial, and operational plans, as well as the goods and services it offers.

Although there are significant variations between for-profit and nonprofit organizations, many of the same rules still apply. In actuality, non-profit organizations require the same level of systematic planning as for-profit companies. Likewise, a nonprofit business plan will also demand a business strategy.

To ensure your strategy and ongoing actions are in line with the initial plan, there should be a timely update to refer back to this plan multiple times a year. Otherwise, it may seem increasingly difficult to achieve your nonprofit business goals. The goal is to gauge your progress toward the outcome you had in mind when the nonprofit organization was first established.

Your nonprofit business plan is essentially a road map. It can also serve as a great tool for measuring progress. Not to mention, it brings your team together in complete agreement with your objectives, challenges, and strategies. Your business plan outlines the objectives for the coming years, which you may then accomplish gradually.

V

Why Does a Nonprofit Need a Business Plan?

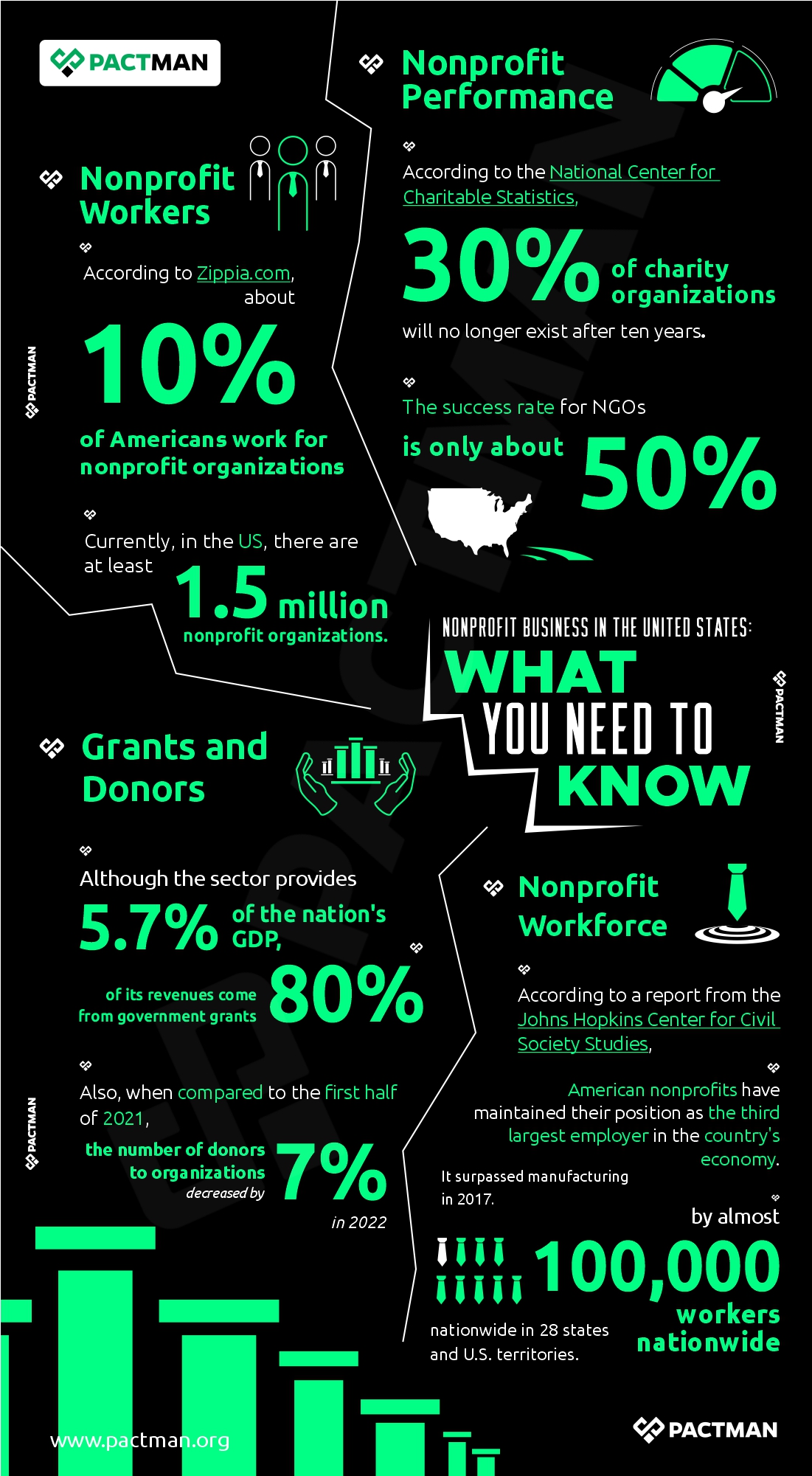

According to the National Center for Charitable Statistics, 30% of charity organizations will no longer exist after ten years. Not to mention, the success rate for NGOs is only about 50%. With these statistics, it is safe to say that a nonprofit business plan is a requisite. In the current season, NGOs must be equipped to manage a financially sound business even if increasing profits isn’t the main objective.

Also, with about 10% of Americans working for nonprofit organizations, none can dispute the critical role the sector plays in the productivity of the nation.

A good business plan gives an organization the opportunity to assess its core goals, the funding required to realize its mission and the strategy for undertaking future operations.

Currently, in the US, there are 1.5 million nonprofit organizations. Although the sector provides 5.7% of the nation’s GDP, 80% of its revenues come from government grants. Also, when compared to the first half of 2021, the number of donors to organizations decreased by 7% in 2022. These statistics prove that nonprofits need to seek more stable ways of obtaining funds if they intend to remain in operation.

A strong business plan can be used not just internally but also to attract significant funders who are interested in learning more about the inner workings of your organization as well as its financial stability and responsibility. Furthermore, lenders insist on a comprehensive business plan if an NGO wants to obtain external funds for capital expenses.

Here are a few significant benefits of a nonprofit business plan.

- Serves as an effective tool to convince specific individuals or foundations to fund projects

- Assist in appointing board members who can serve as a compass for the entire nonprofit organization.

- Prevents participants from veering off course or wandering while helping them understand what they are committing themselves to.

- Can provide an advantage when seeking business loans.

VI

What Are The Components of a Nonprofit Business Plan?

Basically, setting goals, keeping everyone on the same page, monitoring performance indicators, and continuously improving are all important components of good company planning. Likewise, there are a few elements that ought to be in any nonprofit business plan. The specifics on the other hand may vary depending on the organization. Here are the major components to highlight when developing your business plan.

a. Executive Summary

The contents of the business plan are briefly broken down in the executive summary. The goal here is to write an engaging summary that will pique the reader’s interest long enough for them to read the entire outline.

The CEO should outline the organization’s goals in this area, as well as give a brief history of how and why it came to be. He or she can also give an overview of the nonprofit’s offerings. The founder should also describe the company’s marketing and financial plans.

b. Organizational Structure

Simply describe the nonprofit’s organizational structure in this area, from the board of directors down to the executive staff. In addition, the leader should discuss goals, scaling-up techniques, subsidiaries (if any), and some current developments in the nonprofit sector.

c. Products, Programs, or Services Rendered

In this section, there should be a more thorough explanation of the goods and services that were included in the executive summary. This should also take into account distinctive elements like the modes of delivery, the sources of the goods, the advantages of the non-profit’s goods and services, as well as the organization’s future development objectives. The nonprofit should detail any copyrights or patents it may have in this section as well.

d. Marketing Plan

What demographic or target market does the business plan serve? How does the organization intend to get in touch with them? What region does the nonprofit hope to reach? These questions should have thorough responses in the marketing plan. For instance, the owner should list the organizations that his nonprofit competes with as well as any prospective allies.

e. Operational Plan

This aspect deals with how the nonprofit organization plans to respond to queries like: How does the nonprofit deliver its goods or services? Where is its primary facility located? Are there any inventory or equipment requirements for the nonprofit? In essence, the organization should outline the precise methods intended to be employed to keep the organization running. In addition, the effect of the nonprofit’s programs and services on customers and the general community is also covered in this section.

f. Management and Organizational Team

The personnel in the management team are described in this section by name and job title. A list of the board members and their specialties is also included. Using an organizational chart is the simplest way to describe the nonprofit management team.

The chart lists every key employee in the organization along with their various positions. This aspect should also provide the nonprofit’s assessment of its current and prospective staffing requirements. As the group expands, it might need to bring on board more volunteers, an IT pro, accountants, and other professionals.

g. Capitalization

Another component of a nonprofit’s business plan that shouldn’t be overlooked is capitalization. The owner should be responsible for listing all of the nonprofit’s outstanding bonds, loans, and endowments in this section. Grants from the public or private sector that the nonprofit has applied for or received are referred to as endowments.

h. Appendix

This should comprise the purpose and vision statements, promotional materials, important employees’ resumes, a list of the board of directors, pertinent charts, and graphs. And, if the nonprofit is not a startup, an annual report should be in the appendix.

VII

How to Write a Nonprofit Business Plan

Surprisingly, writing a nonprofit business plan is not all that different from doing so for a conventional company. Also, be sure to keep in mind that the process of creating a company plan is ongoing. Hence, writing a static physical document is not enough. You also need an action plan and a strategy that changes over time as your firm grows.

You can choose to adopt these general guidelines in writing your business plan.

a. Consider your audience

Keep in mind that not every reader of your strategy will be as skilled and experienced as you are. Do not use any acronyms, jargon, or other strange phrases. You’ll have a better chance of keeping the reader interested if you write for a broad audience.

b. Describe your strategy

Create an overview of a nonprofit business strategy. You’ll realize what data you need to obtain to build the strategy once you know what information that should be included in it. Do you require information from the previous two years? Create an outline for each section.

c. Employ basic formatting

Your business plan will be easy to read and appealing to the eye with a straightforward format. Stick to Times New Roman or Arial in a 12-point typeface. Make the lines 1.5 or double-spaced, with readable margins of one inch on either side. With this format, the document will have more white space, which will make it appear less crowded.

d. Clearly divide sections

Your business plan should have titles and distinct sheets for each section. Don’t continue if your previous section ended in the middle of the page. Rather, begin your next section on the following page. This allows the reader to reflect on the piece before moving on.

e. Visually represent your data

The data can be made much more fascinating by including a few eye-catching charts and graphs when you’re laying down the facts and figures in your nonprofit business plan. Certainly, you can leave it up to the reader to interpret the text and come to their conclusions, but using data that is expressed visually can retain their attention longer.

f. Employ an editor

The best write-ups still require editing. Hence, after putting so much effort into your plan, the last thing you want is for any errors in grammar or spelling to diminish its credibility.

Also, it can be challenging to spot your errors when you’re deeply immersed in the composition of a lengthy text. The same line can only be read so many times before it starts to sound absurd. After you’ve completed writing every section of your plan, hire an editor or have a few individuals proofread it for you.

g. Maintain an upbeat tone

Give specifics about your strategy for undertaking some of your organization’s initiatives. If you’re all about assisting the poor and depraved, describe your services. Put yourself forward as the answer to a dilemma and emphasize the goals you have in mind.

The business plan can be used by a nonprofit organization at any time and can also be modified as needed. However, in comparison to a more established nonprofit, the business strategy for a newly established NGO can be relatively condensed.

VIII

Some Tax Considerations

Even though Nonprofits (especially 501c3 nonprofits in the U.S) generally don’t pay tax, there is an expectation of taxation for Unrelated Business Income. A Nonprofit running a business (as at 2023) will likely need to pay tax if it is making a “profit” over $1,000 on the income made from the “Unrelated Business income”: After subtracting costs directly related to the business from gross revenue generated directly from the business, a profit can be calculated, and a tax liability attributed to the business. There are some scenarios that exempt a Nonprofit from paying UBIT (Unrelated Business Income tax).Some of the exempted scenarios are listed below:

- If the work in the Nonprofit Business is done primarily by volunteers

- If the business is not regularly carried on (i.e. – if you hosted a bake sale for 1 month out of 1 year, and you made a profit from this – this will be considered different from running a bakery for 1 year, 7 days a week).

- If the unrelated business income is derived from selling donated merchandise

- Some types of investment income, rental income and capital gains are exempted

- Income from certain Bingo Games

- Qualified sponsorship payments from Businesses.

- Some Advertising income

- If you earn less than $1,000 from unrelated business income in a tax year.

Ultimately, consult your tax attorney and/or cpa before taking any action that can impact your nonprofit’s tax liability at the end of the year.

Conclusion

The health of the nonprofit sector tends to affect the whole nation. According to a report from the Johns Hopkins Center for Civil Society Studies, American nonprofits have maintained their position as the third largest employer in the country’s economy. It surpassed manufacturing in 2017 by almost 100,000 workers nationwide in 28 states and U.S. territories. This shows the critical role that nonprofits play in the nation.

And like any business, nonprofit organizations require good management. The most effective approach to do this is to create a business strategy. Likewise, research, preparation, and hard work are required when starting a charity.

To monitor your progress in relation to your strategy, it is imperative that you hold regular plan review sessions. This will take place in conjunction with regular board meetings and reporting for the majority of NGOs. Now more than ever, nonprofits must review their organizational structure to determine if it has what it takes to remain in operation during the coming years.

One Response