I

Introduction

Financial analysis is critical to a nonprofit as it is a yardstick for evaluating its financial health. The core of a nonprofit organisation comprises members, funds, and a mission. Hence, since an NPO’s mission is the driving force behind its existence, it makes sense to examine financial resources in relation to both the mission and the people it serves.

To begin with, an NPO’s mission statement serves as its main focal point and the basis for its existence. However, without members, a mission cannot exist. Also, despite being involved in the provision of health services, education, personal social services, and cultural services of various kinds, NPOs tend to differ from businesses and government agencies that offer similar services because of the centrality of their mission and membership.

As a result, developing a financial analysis involves a number of crucial processes, including trend and ratio analysis. Ratio analysis, which measures financial performance, prioritises issues that are important to the organisation. Likewise, it helps identify strengths and weaknesses within the organisation by pointing out financial anomalies.

II

What is Financial Analysis?

Financial analysis is the process of evaluating financial data to see how well or poorly an organisation is performing financially. All organisations, including nonprofits, must regularly conduct financial analysis in order to achieve long-term success and financial stability.

For nonprofits, financial analysis is critical to the sector’s ability to evaluate its financial health, pinpoint areas that require development, and make well-informed decisions. Even more, an organisation’s ability to lead, manage, and evaluate its efficiency and viability will depend on its ability to comprehend the complexities of nonprofit finances. By and large, it entails performing practical analyses of financial data and offering suggestions on how the organisation can remain sustainable.

Additionally, financial analysis enables nonprofit leaders to plan for the future. As part of this procedure, there is need to examine the income, balance, and cash flow statements. For example, analysts in several financial domains frequently invest a great deal of time and energy in examining the cash flow features of different organisations. Cash from funds and operating activities among others is displayed in the cash flow statement.

III

Critical Statistics on Financial Analysis

In this section, we will consider the importance of financial analysis for nonprofits by highlighting critical statistics.

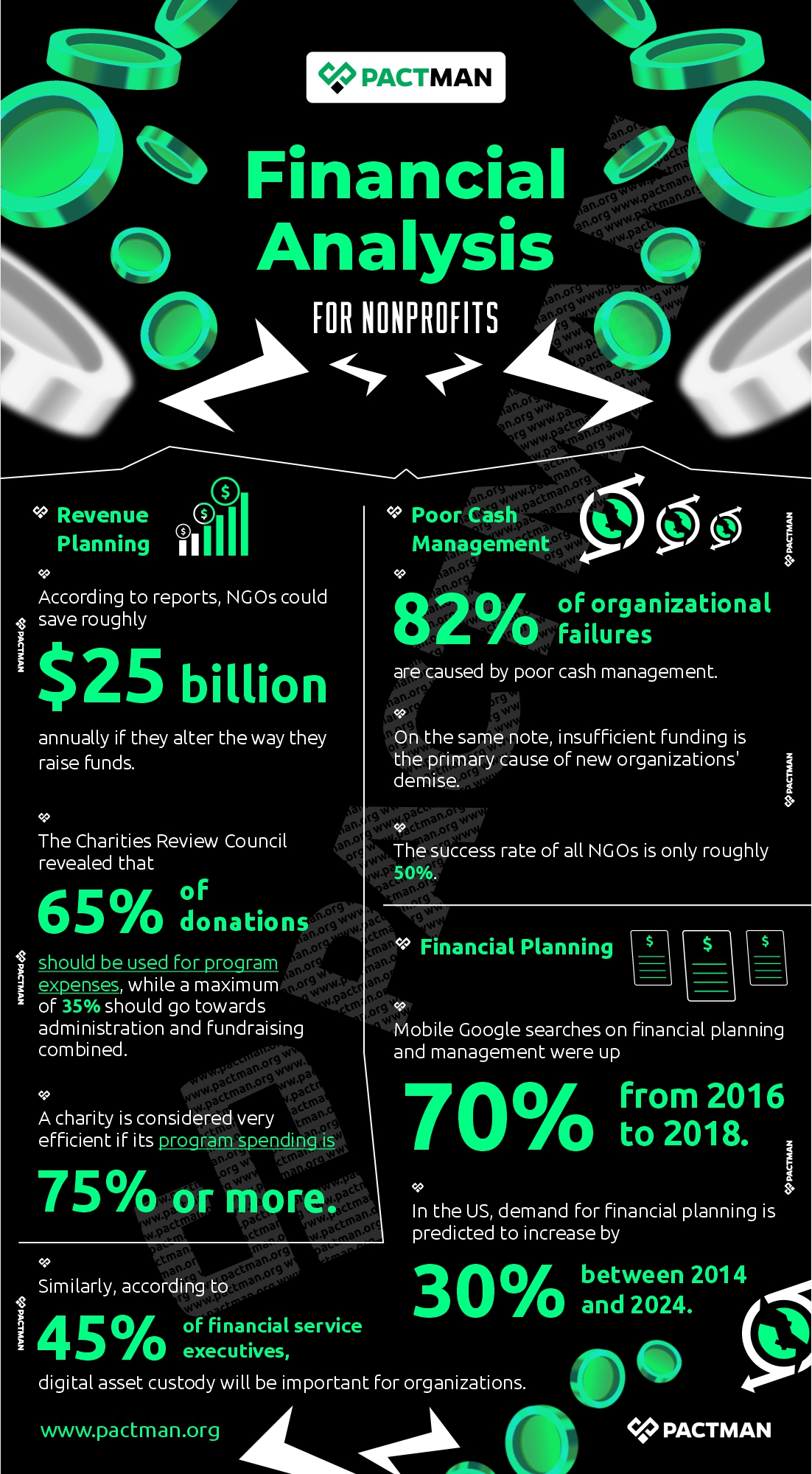

a. Revenue Planning

According to reports, NGOs could save roughly $25 billion annually if they alter the way they raise funds. The Charities Review Council revealed that 65% of donations should be used for programme expenses, while a maximum of 35% should go towards administration and fundraising combined. Also, a charity is considered to be very efficient if its program spending is 75% or more.

b. Poor Cash Management

82% of organisational failures are caused by poor cash management. On the same note, insufficient funding is the primary cause of new organisations’ demise. Thus, the success rate of all NGOs is only roughly 50%.

c. Financial Planning

Mobile Google searches on financial planning and management were up 70% from 2016 to 2018. In the US, demand for financial planning is predicted to increase by 30% between 2014 and 2024. Similarly, according to 45% of financial service executives, digital asset custody will be important for organisations.

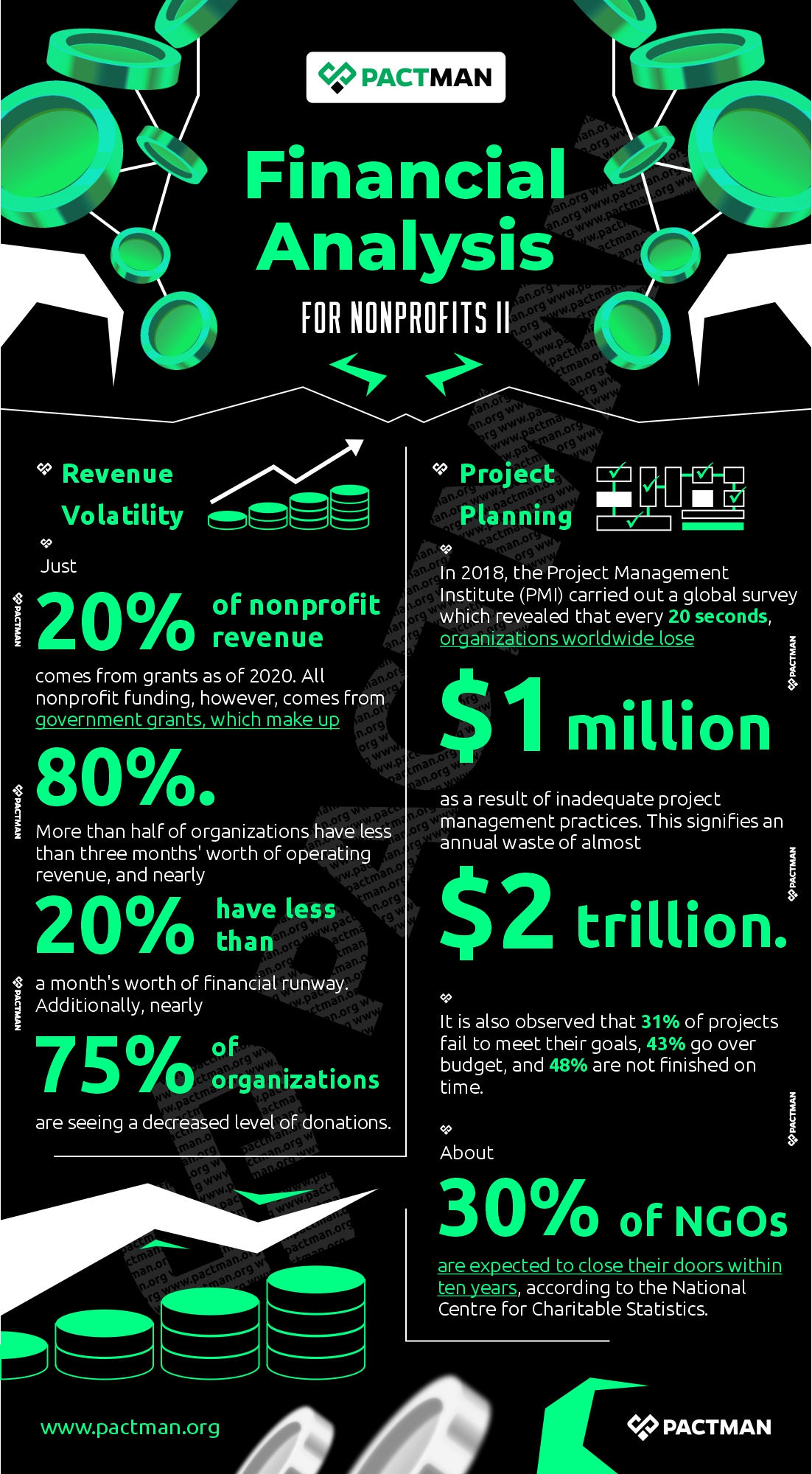

d. Revenue Volatility

Just 20% of nonprofit revenue comes from grants as of 2020. All nonprofit funding, however, comes from government grants, which make up 80%. Also, more than half of organisations have less than three months’ worth of operating revenue, and nearly 20% have less than a month’s worth of financial runway. Additionally, nearly 75% of organisations are seeing a decreased level of donations.

e. Project Planning

In 2018, the Project Management Institute (PMI) global survey revealed that every 20 seconds, organisations worldwide lose $1 million due to inadequate project management practices leading to inefficient implementation of organisational strategy. This signifies an annual waste of almost $2 trillion.

It is also observed that 31% of projects fail to meet their goals, 43% go over budget, and 48% are not completed on time. About 30% of NGOs are expected to close their doors within ten years, according to the National Centre for Charitable Statistics.

IV

Is Financial Analysis Important for Nonprofits?

The use of accounting data to support organisational control may be neglected by some NGOs. Essentially, this oversight is largely caused by the organisation’s culture and basic lack of a profit-oriented mindset. As such, the mission statement of a nonprofit organisation (NPO) serves as its foundation.

Also, since nonprofits are member-focused rather than profit-oriented, organisational success can be measured based on exceptional skills at certain operational tasks.

Lacking an early professional management orientation, many NPOs were founded on a “cause.” This pattern is still noticeable, as various large and medium-sized NPOs investigated in the USA do not have any employees with accounting training.

The emergence of accounting at different points in the histories of numerous NPOs seems to be related to difficult periods. In a bid to make things better, the organisation may call special conferences, hold special meetings, make special appeals, and hire facilitators. This supports the belief that accounting arises in partially bureaucratised or rationalised settings.

Also, the scope of financial planning may be limited to an annual operating budget. This is created separately and not as a component of a long-term strategic plan.

-

NPO’s response to change

More often than not, NPOs frequently have a tendency to respond to events and changing circumstances rather than planning ahead. Likewise, their systems have evolved as reactions as opposed to initiatives.

Not to mention, the few nonprofits that embraced activity-based costing as a financial management technique did so to project an image of being up-to-date and modern to its external controlling environment. This is rather contrary as the technique is meant to be applied for the purpose of enhancing their financial management system.

-

Accountability system for NPOs

Given the preceding, it is certain that an accounting system can be implemented in a nonprofit. However, it cannot serve as a control or accountability mechanism. The concept of clear accountability may seem strange in a nonprofit that prioritises casual connections, volunteerism, and “niceness.”

Although it is acknowledged that accountability is necessary, the existing case is often different for NGOs. There may be a need to alter the organisation’s culture to include accountability as a positive value. Also, it might be necessary to implement a more formal financial management structure.

We can say that the application of accounting as a control mechanism involves changes to the social and cultural systems of a nonprofit.

V

Financial Statements and Analysis for Nonprofits

As a nonprofit, it is vital to ensure that your organisation is sustainable, has sufficient capital and is well funded even though profitability is not the primary goal. Hence, you will need adequate cash flow to sustain operations and help achieve your nonprofit objectives.

Likewise, there is a need to practise good financial management to maintain transparency and retain the trust of your donors and supporters. Financial analysis allows you to evaluate financial data to review your nonprofit performance.

This section will consider various financial statements and analyses that are crucial for nonprofit organisations.

a. Balance Sheet

The balance sheet, also known as the Statement of Financial Position, is generally regarded as the most significant of financial statements. This is because it contains detailed information.

In its most basic form, it displays at any given point in time, the assets, liabilities, and available capital of your nonprofit. Also, the balance sheet shows your organisation’s worth, the proportion of debt, and much more with the use of ratios. By and large, it can be compared to a scale by some individuals. Liabilities and assets won’t balance until net assets are added to the scale.

Everything that belongs to an organisation is considered an asset, and these are typically arranged based on how easily they can be converted into cash or how liquid they are. Your organisation’s liabilities are all of its debts, which are typically shown in the order in which they must be paid back.

As seen on the balance sheet for NPOs, equity is the total amount of money that has accrued from the organisation’s activities.

b. Income Statement

An income statement which could be monthly, quarterly, or annually can also be referred to as the Statement of Activities. Essentially, it shows the financial activity of your organisation over time, including revenues and expenses.

As funds are received and expenses are settled, most nonprofits see quick changes in their numbers. As a result, it can become difficult to determine true earnings. However, the Income Statement provides an answer to that query. It indicates whether revenue is increasing or decreasing and how much profit remains after operating expenses are subtracted from your nonprofit’s budget.

As such, your nonprofit can choose to pay off debt or use the profit to expand the organisation. The information about your organisation’s assets, liabilities, and other debts is not disclosed in the income statement. Rather, you should refer to the balance sheet to discover whether your organisation is in good or bad financial standing.

Based on projections, many nonprofit organisations also prepare an income statement for the upcoming year. According to GAAP, revenues and expenses must be classified and shown as either unrestricted, temporarily restricted, or permanently restricted on the income statement.

c. Financial Ratio Analysis and Mission

Ratio analysis is a widely used method to assess the financial stability, liquidity, and profitability of an entire organisation. Within an organisation, this analysis helps to make comparisons easier by formalising and quantifying financial data.

More importantly, ratio analysis is a useful tool for forecasting an organisation’s ability to pay debts on time, operate in a way that is consistent with its mission, and avoid leaving future deficits. Also, it helps reduce financial data to a more understandable ground. This allows decision-makers to evaluate financial conditions and operating performance.

In addition, the financial performance tool can be used to identify the strengths and weaknesses of an organisation. The goal is to highlight issues of organisational importance and identify financial anomalies. Since the purpose of a nonprofit is the basis for its existence, it makes sense to concentrate on financial resources in connection to its mission.

A group of symptoms indicates a suitable course of action, and each ratio is intended to identify a specific kind of symptom in connection to the organisation’s overall health.

In summary, your nonprofit will accomplish its strategic goals in a financially sound way by putting good financial management into practice.

VI

Nonprofit Tips for Financial Analysis

Financial analysis provides a great way to evaluate the worth and performance of your nonprofit. Also, conducting an analysis can help you assess your nonprofit’s financial stability. Here are some effective tips for performing financial analysis.

a. Compare Financial Outcomes

It’s imperative that your nonprofit compares the financial outcomes to its associated budget each month. The majority of financial software systems enable monthly budget entry and generate statements that show the difference between actual and planned results.

To begin with, investigate any differences above a predetermined threshold, either in terms of money or percentage. A smaller nonprofit, for instance, might base this sum of money on the amount specified in its check-signing policy. Alternatively, as a general guideline, a variance of 5% to 10% is frequently employed. With the help of this variance policy, you can evaluate the effectiveness of individual programs and departments and assess operations promptly.

b. Forecast Figures

In today’s lean economy, making plans for the near future is essential. A projection of the results for the entire year can be created. This is by comparing the actual monthly results up to the most recent month and adding the future budgeted monthly amounts.

The financial situation of the organisation over a given time frame might point to the need for increased revenue or reduced spending. Most importantly, the projection ought to clarify if you’re sticking to your initial spending plan or if it needs to be altered.

A cash-flow projection can be prepared using a similar model, which is especially useful for nonprofit organisations with cyclical cash needs. Your ability to plan ahead and make wise investment decisions can be enhanced by the projection. For example, if the analysis indicates that you have extra cash in September but will need to use it in February, you can choose to invest the money so that it can be accessible later.

c. Use Numbers to Strategise

The organisation’s ability to fulfil its mission should be assessed using financial data. You can ascertain if you achieve particular goals by keeping an eye on program information derived from comprehensive financial records.

If your goal is to increase membership by 15%, look over the total amount of membership fees that have been collected and assess your success. Also, you can use the monthly statement of activities to track pledges and donor payments if you require $2 million to construct a new facility.

d. Make Financials Easy to Understand

The financial data for your nonprofit will be needed when management and the board assess risk and make strategic choices. Hence, statements should be readily available to the decision-makers and presented understandably.

The accounting firm doing the audit should provide this information to the board if your nonprofit has an annual financial statement audit. Additionally, it is best to provide grantors, donors, and prospective donors with access to the financial statements to see how their money is being spent. Utilise this resource as most decisions are impacted by financial facts.

You should keep in mind that no one metric can fully capture the financial status of an organisation.

VII

Top Financial Analysis Tools for Nonprofits

With the abundance of tools at our disposal, cracking the code of financial analysis has never been easier. In an increasingly data-driven world, nonprofit leaders can use both traditional number-crunching and state-of-the-art software to interpret complex financial data.

In this section, we will highlight some of the most effective tools for nonprofit financial analysis.

a. Causal

This financial analysis software is a great choice for nonprofits looking for a visual planning and reporting tool that is ideal for data-driven growth. Causal makes it simple to build models and share them via easily understood visual dashboards.

Furthermore, Causal updates all of your models automatically. You can understand the model with ease thanks to the readable and natural formulas.

The tool can also be used to increase team engagement and collaboration. With Causal’s interactive calculator, understanding the return on investment (ROI) of goods and services is made much more straightforward compared to using a spreadsheet.

b. Budgyt

When it comes to forecasting, reporting, and budgeting, Budgyt stands out as a useful tool. Nonprofits can leverage the software for simplifying complex financial planning needs. As a result, finance teams and CFOs can manage multiple departments and users from a single source. Organisations can also streamline processes and integrate financials seamlessly.

NGOs can use Budgyt as a useful tool to make faster and more informed decisions. In addition, the tool is incredibly useful for real-time data, automatic aggregation, and quality assurance.

c. Celonis

Celonis allows you to identify current value possibilities in your finance operations. With Celonis EMS, you can also discover these opportunities for value and take action to make quick financial decisions.

A great way to give a 360-degree view of the processes in your organisation is to combine all data insights and push actions back into pertinent systems. You can achieve this with the help of the Celonis Execution Management System.

d. Clockwork

Plug-and-play financial planning software, Clockwork, connects to both Xero and QuickBooks. Furthermore, the programs can quickly generate customised forecasts and predictions with CFO-level accuracy.

Clockwork strikes a balance between complete financial transparency and user-friendliness.

Organisations can increase revenue and offer high-value advisory services by utilising Clockwork’s platform. Tools like activity dashboards, forecasting, spreadsheet management, invoice analysis, invoicing, and personalised scenario planning are all included in the software.

To sum up, it is important for nonprofit leaders to comprehend the financial effects of every choice they make. Hence, the most effective way to begin is by leveraging financial analysis tools. Organisations can plan their strategy, identify the best investments, and evaluate performance with the aid of financial analysis.

Even more, examining financial data may reveal issues or opportunities. Additionally, you can assess your nonprofit’s position and overall health.

Conclusion

Accurate financial statements are produced by precise recordkeeping, which is the foundation of good financial analysis and management. Effective financial systems can help with managing and keeping an eye on the organisation’s finances as well as determining its level of success.

Also, to ensure that proposed activities are both financially feasible and sustainable in the long term, the organisation will need to use historical financial information to plan for future operations.

Hence, all nonprofit managers must possess sound financial information and comprehend its application in making future plans. Financial management of the organisation will be enhanced by understanding how to interpret financial statements and apply the data to enhance operations.