I

Introduction

In this article, we will consider the imperative of adopting an ESG Strategy among grantmaking foundations and donors. For those involved in philanthropy, it is quite easy to believe that their primary responsibility is to choose whom to finance. Consequently, poor investment, inadequate management, and flawed planning are the outcomes of this genuine risk.

We would all probably agree that an ESG Strategy investment involves a lot of decision-making. Hence, grantmaking foundations must prioritise choices on the specific region to concentrate on, the kind of grantees to look for, the geographic regions to serve, and, of course, the ideas to fund and not to fund. All in all:

- Every decision you make will affect other decisions.

- Any decision can restrict your options in other areas or completely rule out other options.

- If you don’t understand how decisions relate to one another, you’re asking for trouble.

Essentially, what does an ESG Strategy investment seek to achieve? Usually, the purpose is to fulfil a societal duty or alter social circumstances. These actions are made possible by funders such as grantmaking foundations, which do not carry them out themselves. As a result, they have little direct influence over the results, outputs, and impact of the programs and organisations they support. Given this, where should they focus their attention?

The majority of philanthropic literature has focused on what should be funded rather than how. Although the “what” is a significant ethical and policy issue, the process, which guarantees the most impact, needs to be given more attention.

II

Critical Statistics on ESG Strategy

In this section, we will consider critical trends in ESG strategy that are shaping global giving.

a. Social impact investment

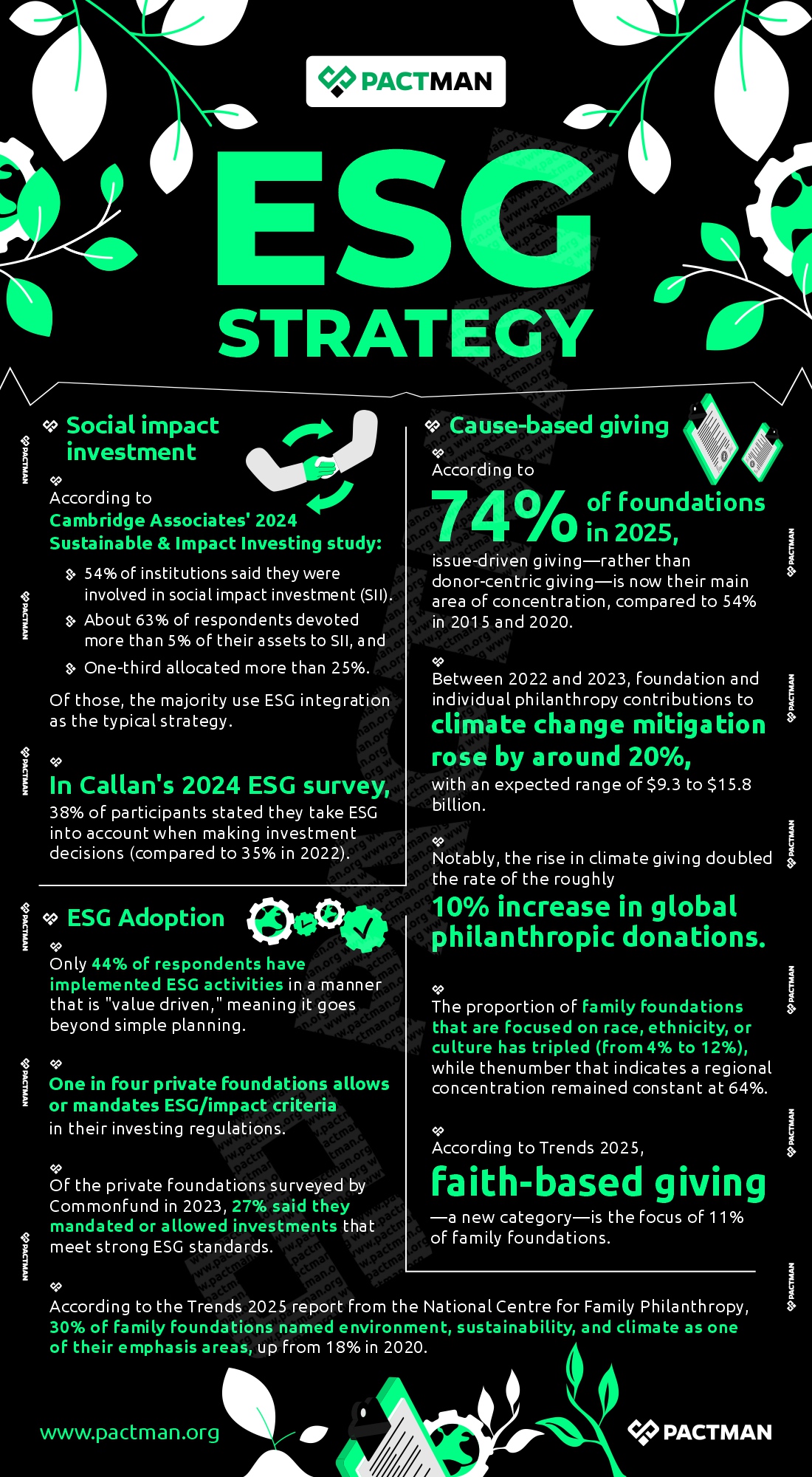

According to Cambridge Associates’ 2024 Sustainable & Impact Investing study:

- 54% of institutions said they were involved in social impact investment (SII).

- About 63% of respondents devoted more than 5% of their assets to SII, and

- One-third allocated more than 25%.

Of those, the majority use ESG integration as the typical strategy.

Also, in Callan’s 2024 ESG survey, 38% of participants stated they take ESG into account when making investment decisions (compared to 35% in 2022). Also, adding ESG wording to the Investment Policy Statement (IPS) is the most popular first step, while a rising minority also uses divestiture.

b. Cause-based giving

According to 74% of foundations in 2025, issue-driven giving—rather than donor-centric giving—is now their main area of concentration, compared to 54% in 2015 and 2020. Additionally, these foundations provide details about the subject or issues they support.

Between 2022 and 2023, foundation and individual philanthropy contributions to climate change mitigation rose by around 20%, with an expected range of $9.3 to $15.8 billion. Notably, the rise in climate giving doubled the rate of the roughly 10% increase in global philanthropic donations.

The proportion of family foundations focused on race, ethnicity, or culture has tripled (from 4% to 12%), while the number indicating a regional concentration remained constant at 64%. According to Trends 2025, faith-based giving—a new category—is the focus of 11% of family foundations.

c. ESG Strategy Adoption

Merely 44% of respondents have implemented ESG activities in a manner that is “value-driven,” meaning it goes beyond simple planning.

One in four private foundations allows or mandates ESG/impact criteria in their investing regulations. Of the private foundations surveyed by Commonfund in 2023, 27% said they mandated or allowed investments that meet strong ESG standards.

According to the Trends 2025 report from the National Centre for Family Philanthropy, 30% of family foundations named environment, sustainability, and climate as one of their emphasis areas, up from 18% in 2020. This indicates that program goals are increasingly overlapping with ESG issues.

III

Effective ESG Strategy for Grantmaking Foundations

In this section, we will outline effective strategies that grantmaking foundations can adopt when choosing to fund nonprofits.

1. Embrace Impact Investment

A grant must be provided without any expectation of financial or personal gain. Hence, a donation to a political party would not be accepted because it might be interpreted as a means of acquiring influence. Rather, it is for the recipient’s benefit, who could be a person or an organisation.

To begin with, foundations in prioritising an ESG strategy should examine their own operations. This includes the way they engage and treat their stakeholders (community, nonprofit partners, and workers), and create publicly shared objectives and track their achievement.

For instance, the Bonfils Stanton Foundation has gone so far as to post its goals on its website and is creating plans to be fully open about its progress in impact investing. It is also working on a new strategic plan that is based on equity and outlines its intended impact on the Denver community.

Similarly, foundations should impose stricter requirements on grantees to create a sound ESG strategy and then make their findings available to the public. Specific grants or programs may involve this type of goal-setting and private reporting. However, nonprofits rarely set goals in public and then report on them consistently. This process, when implemented, can bring about societal impact and lead to more transparency.

2. Adopt the theory of social change in the ESG Strategy

When it comes to an ESG Strategy, grantmaking foundations that wish to effect change must also hold opinions about the kinds and levels of intervention that will best support social movements. The term “theory of change” affirms this perspective on how to effect change. Regardless of whether it is publicly stated or not, grantmaking foundations need to have some kind of “theory of change” to guide their actions. There would be no way for them to decide what to finance without it.

Actually, people who claim to be “open to all” have some sort of “theory,” even if it is quite subjective. Applying your “theory” demands having a model of how the world works, specifically how a funding method may impact it. This procedure makes use of what is known as a logic model. Essentially, a logic model is a type of flow chart, which is a diagrammatic depiction of how a process operates. Taken from an evaluation, the phrase is typically used to describe social processes in an effort to comprehend how changes have occurred or may occur.

It also suggests that if a particular event occurs, a consequence will follow. This “if”/”then” link is the model’s “logical” component. It is likely that the concept of logic models still exists even though most grantmaking foundations do not go to the trouble of recording them and may not even know what the term means. Without it, they wouldn’t be able to trust that their grants will make a difference.

The more complicated a given issue, program, or project is, the more probable it is that some kind of logic modelling will need to be done. Likewise, the model can be recorded, either as a straightforward “timeline” or as a more intricate collection of interconnected causes and effects.

3. Establish a Monitoring and evaluation process

As a grantmaking foundation, there are seven key project areas to ensure that the right questions are asked:

(1) Objective: What outcomes are we hoping for?

(2) Purpose: Why are we doing this?

(3) Deliverables: What are the outputs?

(4) Activities: How are we going to produce the results?

(5) Achievement indicators: How will we be able to tell if we’ve succeeded?

(6) Verification methods: How will we confirm the outcomes we have reported?

(7) Assumptions and risks: What presumptions form the basis of our project’s structure, and what is the chance that they won’t hold true?

Monitoring focuses primarily on outputs, whereas evaluation or assessment focuses on results and impact. The two words can be defined in greater depth as follows:

Monitoring

Monitoring is the process of maintaining tabs on the direction and progress of events. Its main purpose is to inform you of your current location, if you are on course, the reasons behind it, and how to make corrections. Part of the monitoring process includes:

- Determining what data will be helpful,

- Putting in place mechanisms to gather it,

- Gathering the data, and then

- Reviewing it.

Evaluations

Evaluations are intended to determine whether a project accomplished its goals, but they may also inquire as to whether other goals were met. Evaluation may focus on a project’s accomplishments in relation to its cost, rather than just its accomplishments. A primary goal of evaluation is considering and, if at all feasible, comprehending success and failure. Although it might not be as fulfilling as proving success, understanding why something did not work could be equally important.

Also, evaluations can be conducted internally (by the grant recipient) or externally (often by consultants hired by the grantmaking foundation). Although the former is more typical, if you truly want to comprehend a particular undertaking, the latter may frequently be superior. Regardless of the assessment method selected, it must be incorporated into the program from the start. Also, if necessary, baseline studies should be conducted before the start of initiatives.

4. Determine the end result

Funders must be able to determine which organisations and initiatives have the best chance of achieving the results and impact they are looking for. Afterwards, they should take all necessary steps to guarantee these organisations and projects provide the desired results. This can only be accomplished by a solid, well-researched, and efficient procedure. The procedure may involve analysing the facts to draw a well-informed conclusion about a possible future situation.

In this regard, there is no reason why an ESG strategy investment should differ from a business investment. The main difference between them is that grantmaking foundations are looking for far more complex results that call for various metrics. Once more, you can perform this analysis with the help of a strong organisational process.

An ESG strategy investment process should logically be designed at the end, with the results and impacts. Then it should work its way back to the beginning. In funding bids, what qualities indicate that the applicant is likely to produce the desired results? Making decisions on whom to assist becomes much easier once you have such a strategy in place. Additionally, it frees up resources for post-decision management, which is an even more crucial responsibility that helps guarantee your funding truly yields benefits.

It makes no sense for grantmaking foundations to believe that their work is done once a grant has been awarded. Therefore, the post-decision period is where effective funders should concentrate their biggest resources, including personnel and board/trustees.

Conclusion

Without a doubt, good grantmaking is much more about comprehending the system, such as which ESG strategy investments are good. If the goal of a grant is to have a social impact, then a good one must maximise the social impact or return. Also, since an ESG strategy aims to address a wide range of issues, there is a need to maximise the impact. Hence, it calls into question how impact is measured.

3 Responses