I

Introduction

Every organisation, including nonprofits, must monitor its financial health, and one of the finest tools for doing so is a balance sheet. Establishing a set of guidelines or benchmarks for the majority of financial measures may prove improper. Essentially, this is because nonprofits differ in terms of size, structure, income consistency, and other financial factors.

To obtain a precise grasp of financial patterns, nonprofit leaders should be able to explain and comprehend the balance sheet and its significance. This is in addition to tracking a few chosen metrics throughout time.

In this guide, we will go over how to read, evaluate, and use a balance sheet, including clear guidelines specifically designed for nonprofits.

II

What Is a Balance Sheet?

A balance sheet is a type of financial statement that shows an organisation’s “book value,” which is determined by deducting all of its liabilities and shareholder equity from its total assets. The purpose of a balance sheet is to convey the precise value of a business or organisation, often known as its “book value.”

The balance sheet lists and totals all of an organisation’s assets, liabilities, and equity within a specific date, sometimes referred to as the reporting date. As a result, internal and external analysts can see how the organisation is performing in the present, how it did in the past, and how it anticipates performance in the near future using the balance sheet.

Without a doubt, balance sheets are a vital tool for important stakeholders and external regulators who need to know how an organisation is performing at particular times. As a result, it should be balanced at all times. The name itself derives from the fact that an organisation’s assets are equal to its liabilities plus any issued stock to shareholders.

However, one of these factors could be the reason a balance sheet isn’t balancing:

- Missing or incomplete information

- Inaccurately inputting transactions

- Currency exchange rate errors

- Inventory mistakes

- Inaccurate equity computations

- Loan depreciation or

- Amortisation that was not properly computed

Also, a balance sheet is usually generated and disseminated either quarterly or monthly, depending on the frequency of reporting mandated by law or corporate policy. The financial statement is intended to provide information about a nonprofit’s resources and financing methods.

III

Critical Statistics on Balance Sheet

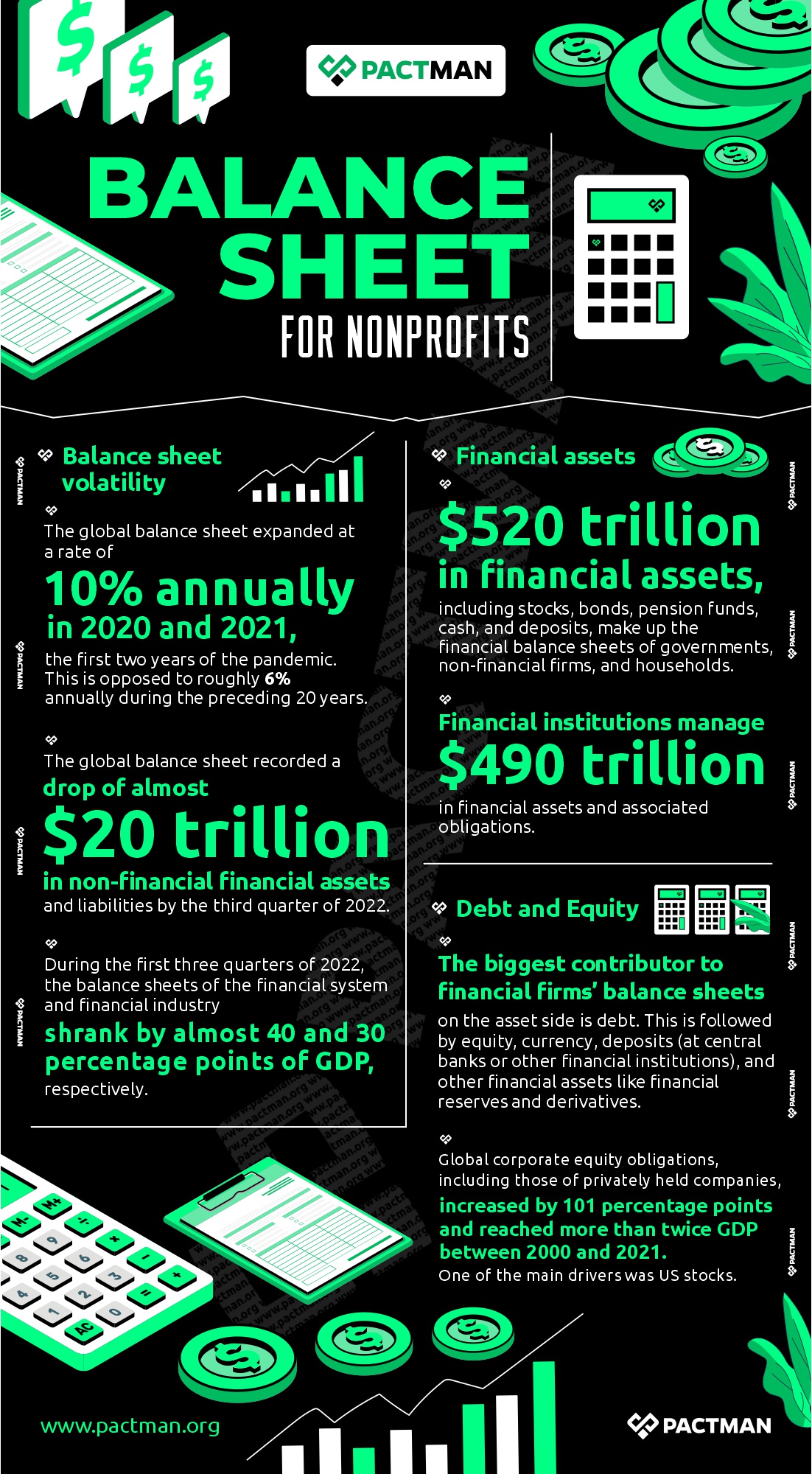

The McKinsey Global Institute leveraged the balance sheet, a fundamental instrument used by businesses, to assess the underlying resilience, health, and prosperity of the global economy. Here are some of the critical statistics based on the global analysis.

1. Balance sheet volatility

The global balance sheet expanded at a rate of 10% annually in 2020 and 2021, the first two years of the pandemic. This is opposed to roughly 6% annually during the preceding 20 years.

Also, the first three quarters of 2022 witnessed volatility and a halt in the multidecade increase of the global balance sheet. This was largely resulting from rising rates and inflation. Even more, the global balance sheet dropped by almost $20 trillion in non-financial financial assets and liabilities by the third quarter of 2022.

Declines in debt instruments, stocks, and real estate caused a shrink in the balance sheet compared to 2022. However, the GDP nominally increased due to high inflation rates. Also, the first three quarters of 2022 recorded a 40 and 30 percentage point shrink in the balance sheets of the financial system and financial industry.

2. Financial assets

$520 trillion in financial assets, including stocks, bonds, pension funds, cash, and deposits, make up the financial balance sheets of governments, nonfinancial firms, and households.

Furthermore, financial institutions manage $490 trillion in financial assets and associated obligations, creating and facilitating those assets and liabilities through changes in size, maturity, and risk.

3. Debt and equity

Debt is the biggest asset contributor to financial firms’ balance sheets. This is followed by equity, currency, deposits (at central banks or other financial institutions), and other financial assets like financial reserves and derivatives. Currency, deposits, equity, and pensions are some financial organisation obligations.

Since 2000, the amount of debt and equity liabilities has increased in relation to GDP, surpassing the amount before the global financial crisis.

Between 2000 and 2021, global corporate equity obligations as well as privately held companies rose to 101 percentage points and reached more than twice GDP. One of the main drivers was US stocks.

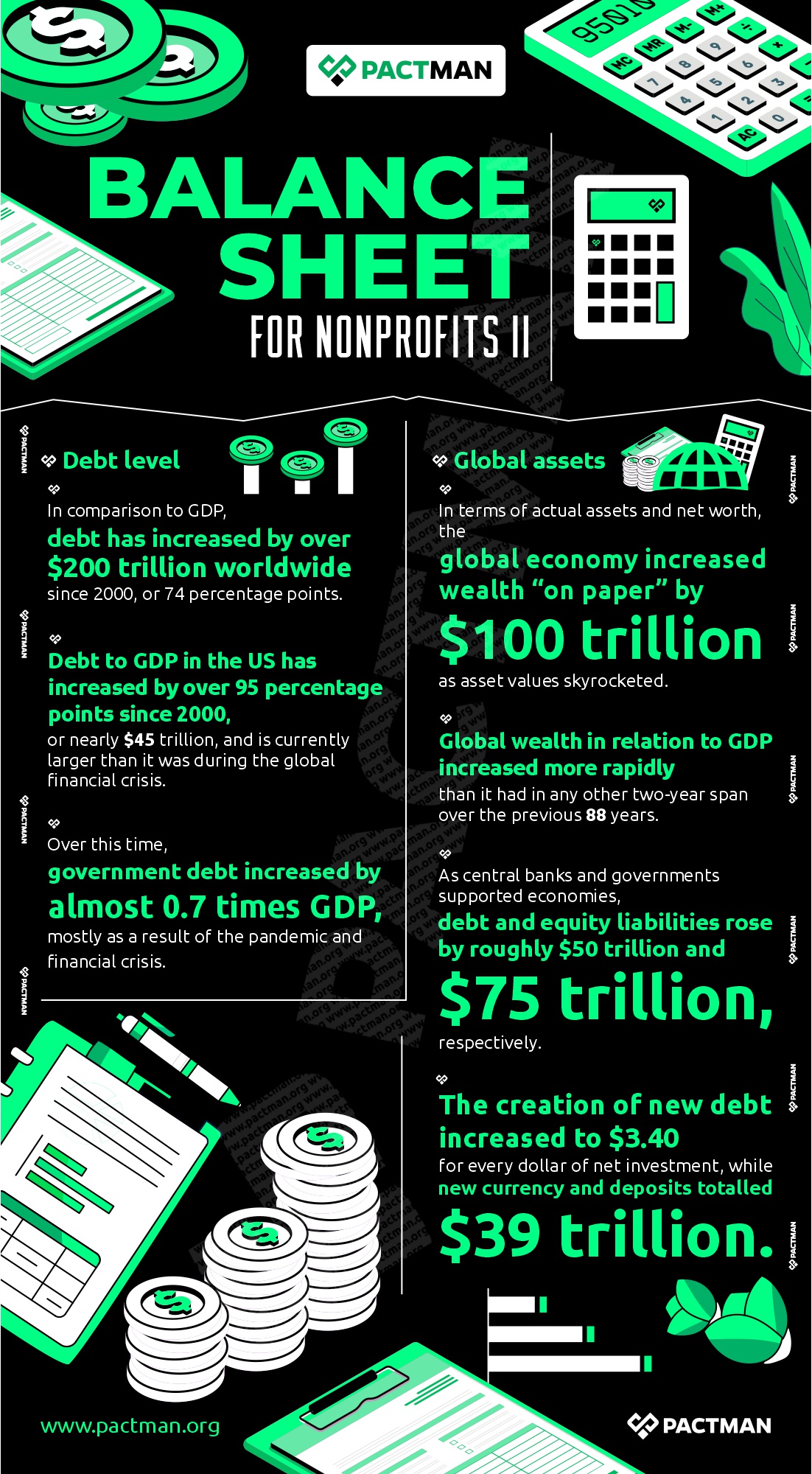

4. Debt level

Interestingly, the ratio of equity liabilities to GDP is considerably higher in China. Due to historically high debt levels, economies are at risk of deleveraging, increased debt servicing costs, and financial fragilities as interest rates rise. In comparison to GDP, debt has increased by over $200 trillion worldwide since 2000, or 74 percentage points. Debt to GDP in the US has increased by over 95 percentage points since 2000, or nearly $45 trillion, and is currently larger than it was during the global financial crisis.

Over this time, government debt increased by almost 0.7 times GDP, mostly as a result of the pandemic and financial crisis.

Although household debt has decreased from its peak in relation to GDP, it is still larger than it was in the early 2000s, just before the global financial crisis began. Financial firms are no different. The trajectory and total debt level in Europe (consisting of 16 EU members plus the UK) have been largely comparable to those in the US.

Private sector debt in Japan decreased in relation to GDP after the 1989 crisis, while public debt rose sharply as a result of numerous initiatives to stabilise and boost the economy. During the severe first two years of the pandemic, which lasted from the end of 2019 to the end of 2021, governments adopted extensive measures to boost economic activity, which caused wealth and liability growth to accelerate dramatically.

5. Global assets

In terms of actual assets and net worth, the global economy increased wealth “on paper” by $100 trillion as asset values skyrocketed. Also, global wealth in relation to GDP increased more rapidly than it had in any other two-year span over the previous 88 years.

Debt and equity liabilities plummeted by $50 trillion and $75 trillion, respectively. Furthermore, the creation of new debt increased to $3.40 for every dollar of net investment, while new currency and deposits totalled $39 trillion.

IV

Why Should Nonprofits Use a Balance Sheet?

A balance sheet is crucial for nonprofit organisations as it provides transparency and a basis for strategic decision-making. Hence, nonprofits can leverage the financial report for the following specific reasons:

1. To provide financial transparency

Gaining the trust of the public, board members, and funders requires transparency. A detailed picture of the nonprofit’s financial situation is provided by the balance sheet, which lists assets, liabilities, and net assets. Furthermore, stakeholders can observe how funds are managed in detail, ensuring that the organisation’s activities are in line with its goals and the expectations of its donors.

2. More Effective Decision-Making

Secondly, a balance sheet gives a quick overview of current assets and liabilities, which aids in decision-making by leadership. Understanding available assets vs liabilities enables the firm to plan for expansion, set reasonable goals, and allocate resources effectively. Consequently, aligning spending with programming requirements is crucial.

3. Better Understanding of a Nonprofit’s Financial Health

To assess the organisation’s sustainability and financial stability, nonprofit directors should regularly analyse the balance sheet. This allows nonprofits to evaluate their long-term viability and spot possible financial hazards by keeping track of their assets (such as cash reserves or investments) and liabilities.

4. Improves Resources Planning

Resource planning is aided by the balance sheet. Better cash flow management, for instance, is made possible by knowing the difference between liquid and fixed assets. This knowledge is essential when organising fundraising events or choosing when to make program or capital asset investments.

5. Monitors Fund Limitations

Funds are frequently given to nonprofits with certain conditions. Net assets are divided into three categories on the balance sheet: unrestricted, temporarily restricted, and permanently restricted. Nonprofits can allocate donations appropriately and ensure they are following donor wishes by keeping track of these categories. This facilitates stakeholder communication over fund usage.

6. Assists with Funding Requests

To comprehend the nonprofit’s financial status, funders frequently examine the balance sheet when evaluating grants or loans. By demonstrating that the organisation has the resources to efficiently handle more funding and carry out its objective, a robust balance sheet can entice investors and indicate stability.

7. Enables Compliance

A key element of financial reporting is the balance sheet, which nonprofits are legally obligated to keep accurate financial records. A properly managed balance sheet helps an organisation stay in compliance with legal and regulatory standards, preventing penalties or problems with audits and tax filings.

8. For Audits and Evaluations

For many nonprofit organisations, particularly those that depend on grants or public financing, audits and assessments are standard procedures. A clean, current balance sheet streamlines audit procedures by arranging financial information. It shows corporate responsibility and gives auditors a foundation on which to assess financial procedures.

9. Tracks Developments Over Time

Nonprofits can monitor changes in assets, liabilities, and net assets over time with the use of a balance sheet, which can help identify areas of financial growth or difficulty. Monitoring these patterns enables leaders to spot opportunities for advancement and successfully handle setbacks. Through the comparison of balance sheets from various periods, charitable organisations can determine whether their financial strategies are working.

10. Long-term Planning and Strategic Vision

Lastly, planning for the future necessitates having a thorough awareness of the financial environment. A foundation for realistic, financially sound goal-setting is provided by the balance sheet. Knowing its present financial situation helps the nonprofit plan strategic initiatives, foresee future financial requirements, and make decisions that support its growth goals and mission.

All things considered, these ideas highlight how a balance sheet improves a nonprofit’s financial management while also fostering accountability, trust, and strategic expansion. By and large, this is crucial for sustainability, enabling NGOs to carry out their work and gradually increase their influence.

V

How Nonprofit Can Use a Balance Sheet

With an overview of each component and procedure to assist organisations, let’s dissect how a nonprofit can use a balance sheet.

1. Understand its Components

Essentially, the three main components of a nonprofit balance sheet are liabilities, assets and net assets.

- Assets: These are what the nonprofit owns. Generally speaking, assets are divided into two categories: non-current assets (such as real estate, machinery, and long-term investments) and current assets (such as cash, accounts receivable, and inventories).

- Liabilities: The nonprofit’s liabilities are what it owes. Additionally, liabilities are separated into long-term liabilities (like mortgages or loans with maturities longer than a year) and current liabilities (like accounts payable and short-term loans).

- Net Assets: After liabilities are subtracted, net assets are the nonprofit’s residual stake in the assets. Nonprofits, in contrast to for-profit businesses, have net assets that may be unfettered, temporarily restricted, or permanently restricted rather than “equity.”

2. Accurately Record All Financial Transactions

Secondly, accurate recording is crucial. Hence, nonprofits should adhere to the following:

- Keep thorough records of all program revenue, grants, gifts, and expenses.

- To appropriately depict the organisation’s actual financial situation, classify assets and liabilities.

3. Regularly Compile and Update Balance Sheet

Every month, every quarter, or at least once a year, nonprofits should prepare or update their balance sheets. This facilitates:

- The monitoring of financial performance over time and

- Helps to keep an eye out for patterns like rising debt or declining cash reserves.

4. Understand Resource Availability through Assets Analysis

Also, nonprofits can evaluate their liquidity and available resources by looking at their assets:

- Current Assets Analysis: Evaluate the amount of cash available for immediate needs. A low cash level can mean that urgent fundraising is required.

- Fixed Assets and Investments: Examine real estate or long-term investments. These assets could be viewed by nonprofits as probable resources to leverage (for example, using them as collateral for loans).

5. Assess Financial Obligations by Evaluating Liabilities

Examine liabilities to comprehend the organisation’s debt and responsibilities:

- Short-term Liabilities: Ensure there are enough assets on hand to pay for immediate liabilities. Cash flow issues may be indicated by a high ratio of liabilities to assets.

- Long-term Liabilities: Keep tabs on any outstanding debts and make a repayment plan. Examining loan conditions and interest rates is another aspect of this process.

6. Review Net Assets to Understand Financial Strength

Information on the nonprofit’s financial stability and funding restrictions can be found in the net assets section:

- Unrestricted Net Assets: These are money that are available for use in any way within the organisation. Financial flexibility is demonstrated by a robust unrestricted fund.

- Restricted Net Assets: This is usually derived from gifts or grants designated for particular initiatives. Keeping an eye on them guarantees that money is used as intended by the giver.

- Building Reserves: To pay for operating costs during hard times, nonprofits should accumulate unfettered reserves.

7. Measure Organisational Health through Financial Ratios Interpretation

Nonprofits can gain insight into their financial health by using specific ratios:

- Current Ratio (Current Assets / Current Liabilities): If the ratio is greater than 1, it means that there are sufficient assets to pay liabilities.

- Debt to Asset Ratio (Total Assets / Total Liabilities): Lower numbers indicate less reliance on debt.

8. Inform Financial Decision-Making With the Use of a Balance Sheet

A balance sheet aids in decision-making for things like:

- Budget Adjustments: The organisation may need to increase fundraising or reduce spending if liabilities exceed assets.

- Program Expansion: If net assets are sufficient, expansion may be warranted.

- Investment Strategies: Surplus funds may be invested to generate returns.

9. Consistently Monitor Financial Trends

Nonprofits can do the following by comparing balance sheets across time:

- Discover trends in financial growth or decline.

- Identify areas that require attention, such as declining cash reserves or growing obligations.

10. Provide Stakeholders Report

Communicate the state of the finances to the board, grantors, and donors using the balance sheet. Openness fosters trust and aids in fundraising initiatives:

- Present Comprehensive Reports: Explain how assets, liabilities, and net assets have changed.

- Emphasise Needs and Financial Goals: Stakeholders get to see how they can support the sustainability of the organisation.

11. Seek the Guidance of Professionals

Lastly, when it comes to complicated asset or liability management, nonprofit organisations may need the help of a financial advisor or accountant. This ensures that the balance sheet complies with regulations and appropriately depicts financial status.

Conclusion

One of the most important financial documents is the balance sheet. It provides a brief overview of an organisation’s financial situation. Hence, Nonprofits must learn how to create them and fix problems when they don’t balance. Some of the most crucial information for a nonprofit leader to comprehend is that which can be found in a balance sheet.

Consequently, it can be difficult to determine if an organisation is doing well or not without this information. As a result, being able to read and comprehend a balance sheet is an essential skill for nonprofit aspirants.