I

Introduction

The nonprofit industry is undergoing a revolution characterised by increased scrutiny, digital complexity, and higher stakeholder expectations. Following high-profile scandals ranging from inflated administrative costs to outright fraud, funders, regulators, and recipients are all calling for greater transparency.

However, several NGOs continue to rely on old systems, compartmentalised databases, and manual compliance checks—all of which were created for a bygone era. According to the 2023 Stanford Social Innovation Review, the majority of nonprofits in the United States lack a systematic risk management strategy. This is largely owing to budget constraints and a sense that risk mitigation is a cost rather than a driver of operational excellence. This reactive approach, however, ignores an important fact: poor governance is a strategic risk as well as an ethical failing.

Modern governance necessitates real-time data visibility, regulatory harmonisation, and flexible decision-making. APIs, when used intelligently, provide a link between scattered systems and unified oversight. Consider this: The IRS Business Master File (BMF), an important source of nonprofit validity, is updated regularly. However, most NGOs only verify records once a year, if at all. Likewise, APIs that connect directly to the IRS BMF, OFAC sanctions lists, and other federal registries can automate continuous monitoring, significantly decreasing fraud and compliance gaps.

Even more, APIs not only minimise risk in a field where mission-critical work is frequently impeded by administrative overhead, but they also increase credibility. Now more than ever, in today’s nonprofit market, credibility is valuable.

II

Understanding the Basics of Nonprofit Risk Management

In the nonprofit industry, risk management is the methodical process of detecting, assessing, and minimising possible risks that can jeopardise stakeholder confidence, financial integrity, mission delivery, or regulatory compliance. Without a doubt, nonprofits are subject to stricter resource limitations and more complicated regulatory environments than corporations. Nevertheless, they are also held to a higher moral standard.

Among the various types of nonprofit risk are operational, reputational, compliance, financial, and strategic risks. These hazards can all be connected to one another. Failure to comply can result in harm to one’s reputation, which can impact funding, setting off a chain of events.

Manual audits, static spreadsheets, and compartmentalised data are examples of traditional risk management technologies that are becoming less and less effective. Now more than ever, tools that are real-time, interoperable, scalable, and economical are essential in today’s nonprofit sector.

Many charitable organisations are hesitant to use APIs despite the advantages because they believe they are complicated, expensive, or lack technical personnel. However, these obstacles have been greatly lowered by low-code platforms and nonprofit API providers.

Here are a few adoption suggestions to consider:

- Start Small: Start with a single API, such as the Pactman Nonprofit Checkplus API for IRS status verification.

- Employee Education: Provide instruction on the fundamentals of APIs and their use in risk reduction.

- Strategic Partnership: Work together with API suppliers who provide nonprofit assistance.

- Workflow Integration: Incorporate API checks into routine procedures such as donor onboarding or grant approvals.

As the industry develops, APIs will be at the heart of risk management, which will be viewed as a strategy rather than merely compliance.

III

Understanding the Basics of Nonprofit Governance

Nonprofit governance is frequently oversimplified as board oversight or regulatory compliance. In reality, it is the strategic and ethical architecture that builds trust, promotes openness, and ensures long-term impact. It encompasses:

- Board Structure and Accountability

- Risk management and fiduciary duties

- Ethical decision-making and stakeholder involvement

- Data management and compliance

A successful governance model is an integrated structure of decision rights, incentives, and controls that drive organisational behaviour. The lesson for NGOs is more profound: governance goes beyond simply control. It is about legitimacy.

Traditional governance procedures, which rely on static reporting, compartmentalised databases, and post-fact audits, are not only wasteful but also potentially harmful. Nonprofits require dynamic, transparent, and technologically enabled governance systems in an environment of rising donor expectations, regulatory requirements, and societal scrutiny.

By and large, APIs improve governance by enabling real-time risk management, transparent financial oversight, and data-driven decision-making. Nonprofit governance involves monitoring KPIs, program outcomes, and governance metrics through automated alerts.

IV

Critical Statistics on Nonprofit Risk Management

In this section, we will consider the impact of risk management on organisational processes using statistics.

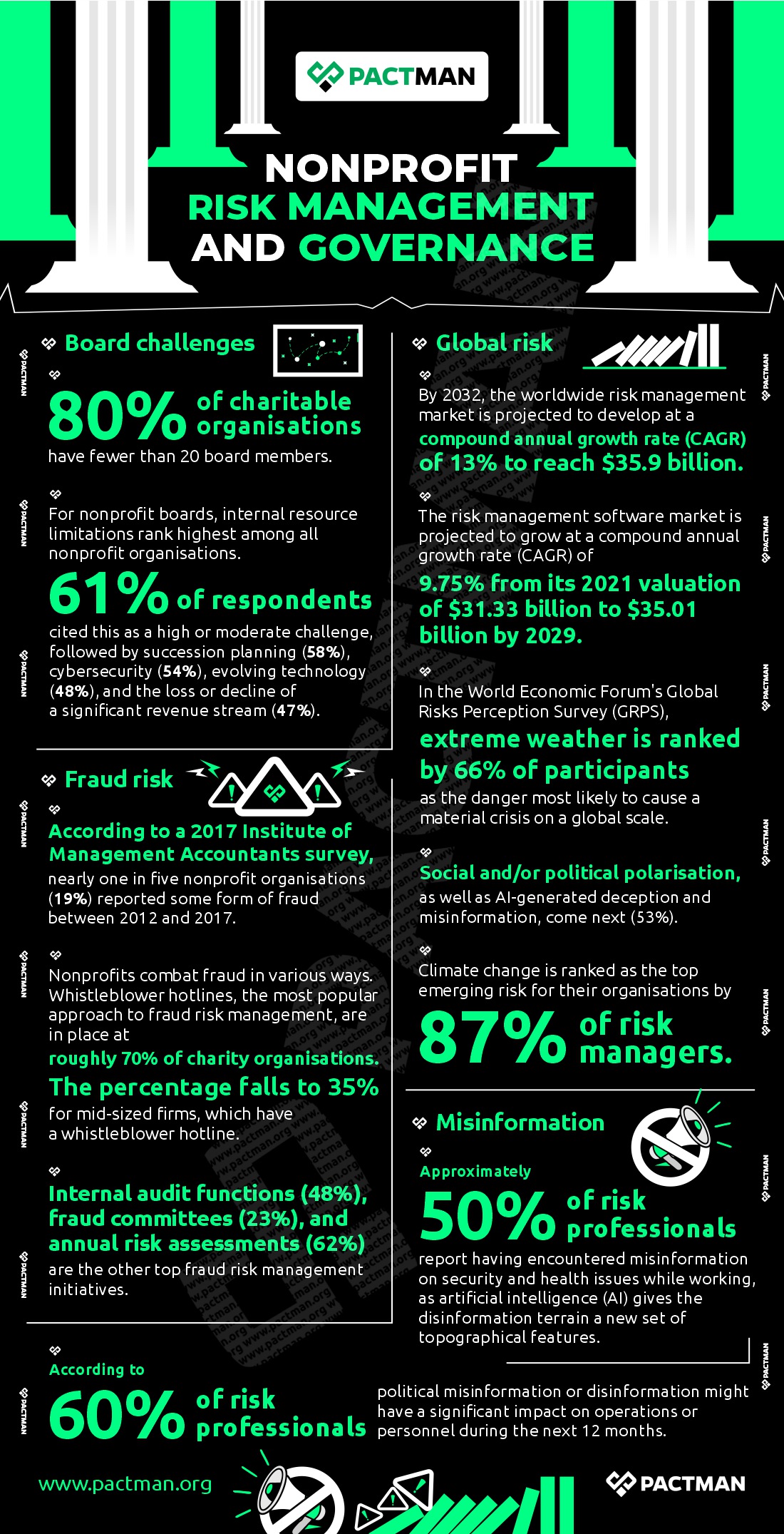

1. Board challenges

45% of charitable organisations have more than 20 board members. For nonprofit boards, internal resource limitations rank highest among all nonprofit organisations. 61% of respondents cited this as a high or moderate challenge, followed by succession planning (58%), cybersecurity (54%), evolving technology (48%), and the loss or decline of a significant revenue stream (47%).

2. Fraud risk

According to a 2017 Institute of Management Accountants survey, nearly one in five nonprofit organisations (19%) reported some form of fraud between 2012 and 2017. Also, nonprofits fight fraud in a variety of ways. Whistleblower hotlines, the most popular approach to fraud risk management, are in place at roughly 70% of charity organisations. The percentage falls to 35% for mid-sized firms, which have a whistleblower hotline. Also, internal audit functions (48%), fraud committees (23%), and annual risk assessments (62%) are the other top fraud risk management initiatives.

3. Global risk

By 2032, the worldwide risk management market is projected to develop at a compound annual growth rate (CAGR) of 13% to reach $35.9 billion. Also, the risk management software market is projected to grow at a compound annual growth rate (CAGR) of 9.75% from its 2021 valuation of $31.33 billion to $35.01 billion by 2029.

In the World Economic Forum’s Global Risks Perception Survey (GRPS), extreme weather is ranked by 66% of participants as the danger most likely to cause a material crisis on a global scale. Social and/or political polarisation, as well as AI-generated deception and misinformation, come next (53%). Climate change is ranked as the top emerging risk for their organisations by 87% of risk managers.

4. Misinformation

Approximately 50% of risk professionals report having encountered misinformation on security and health issues while working, as artificial intelligence (AI) gives the disinformation terrain a new set of topographical features. Also, according to 60% of risk professionals, political misinformation or disinformation might have a significant impact on operations or personnel during the next 12 months.

5. Cyberattacks

Cyberattacks are considered a major concern by 40% of executives. A recent study found that 27% of organisations globally reported experiencing cyberattacks in 2023.

79% of business executives are improving or updating their cyber risk management. According to 60% of risk professionals, investments in privacy and cybersecurity are rising. Also, “cyber threats” rank among the top five long-term risks, according to 90% of executives.

55% of risk managers are spending money to improve their crisis management strategies. Likewise, 65% of companies report that incorporating risk assessments improves their decision-making. A cyberattack typically costs $1.4 million less for businesses with strong risk controls than for those without.

6. Risk management spending

78% of businesses say they have increased their risk management technology spending in the last two years. Businesses with well-developed risk management systems typically cut operational losses by 25%. Proactive risk management procedures cut incident reaction times by 60% for organisations. Predictive accuracy for possible crises rose by 31% when scenario analysis was incorporated into risk management.

7. Risk mitigation

Cybersecurity projects receive 54% of risk management budgets. Artificial intelligence is used by 55% of firms to improve the accuracy of risk predictions. The use of AI-enabled risk management software is growing, as seen by the 57% of firms that utilise it. Also, the application of blockchain technology in risk management has grown by 45% between 2022 and 2023, suggesting that its use is becoming more widespread.

For future risk mitigation, 49% of risk managers believe that cutting-edge technologies like blockchain and IoT are essential. Automating risk assessments will drastically cut down on manual labour, according to 48% of risk professionals.

Also, to promote risk awareness, 71% of businesses provide yearly risk training for staff members. According to 70% of firms, organisational resilience is influenced by risk culture.

Risk management is ranked as a strategic planning priority by 80% of firms. When risk assessments are included in decision-making, 65% of organisations report better results. Also, 67% of firms believe that including environmental, social, and governance (ESG) concerns in their frameworks enhances risk reduction in general.

8. Risk planning

Check or payment tampering (23%), billing fraud (31%), and corruption (44%) are the most prevalent fraud techniques among charities with fewer than 100 employees. Skimming is another common but frequently disregarded hazard, accounting for 10% of occurrences. According to studies, less than half have internal processes or rules in place to regulate how data is shared with other entities, and 68% lack established plans for responding to intrusions.

V

APIs as Strategic Tools for Governance & Risk Mitigation

APIs are frequently described as pipes—technical conduits—that link systems. However, they act more like arteries in the nonprofit governance ecosystem, ensuring that data flows safely, openly, and sensibly.

1. Real-time verification and regulatory compliance

Nonprofits work in a complex environment with constantly changing restrictions. The financial and reputational costs of non-compliance are high, ranging from IRS revocation updates to anti-money laundering (AML) regulations and anti-terrorism checks. Organisations can verify legal status in real time by using APIs. The Pactman Nonprofit Checkplus API, for instance, incorporates information from: IRS Pub 78, Business Master File (BMF), OFAC (Office of Foreign Assets Control) and the Automatic Revocation List for IRS. This eliminates the need for yearly spreadsheets or out-of-date third-party listings by enabling grantmakers and auditors to quickly confirm an organisation’s eligibility, tax-exempt status, and sanction history.

An example is the use of API-driven eligibility checks by a national foundation that disbursed disaster relief funds after a hurricane. This process can verify over 1,200 grantees in less than 48 hours, whereas human verification would take weeks.

2. Due Diligence for Vendors and Beneficiaries

Also, nonprofits often work with regional suppliers, grassroots partners, and international financial intermediaries. Vendors can be automatically screened for fraud, criminal histories, or sanction lists using APIs connected to international databases (such as D&B, LexisNexis, or national corporate registers).

Strategic insight: By including these checks in grant disbursement processes, a “compliance by design” paradigm is established, guaranteeing governance without causing additional complications.

3. Automating Audit Trails and Risk Assessment

Retrospective reviews and sampling transactions are essential to traditional auditing. Hence, by linking with document repositories, CRMs, and financial systems, APIs make dynamic risk scoring possible. APIs can input data into a risk engine that rates transactions in real time by extracting metadata, such as the frequency of fund transfers, variations in award distributions, and missing paperwork.

Likewise, boards and audit teams can take preemptive measures as high-risk activities are promptly recognised. This is in line with the COSO ERM framework (Committee of Sponsoring Organisations of the Treadway Commission), which highlights ongoing monitoring as a governance best practice.

4. Consent and Data Governance Compliance

Lastly, the need for NGOs to protect donor and beneficiary data is growing as a result of the GDPR, CCPA, and other legislation that are being implemented globally. Strong consent management is made possible by APIs, which establish revocable, transparent, and consistent data access points, guaranteeing that organisations are not only compliant but also reputable guardians of private data.

VI

Integrating APIs into Nonprofit Governance Models: Moving from Tools to Strategy

Leveraging APIs can be a strategic shift rather than just a technical improvement. The integration of APIs must be in line with the larger governance objectives of accountability, efficiency, openness, and stakeholder confidence.

1. The Function of the Board in API Governance

Nonprofit boards have always prioritised mission alignment, financial stewardship, and supervision. However, technical fluency is a governance requirement in the digital age. Boards must ensure that the organisation’s adopted APIs cover the following important risk areas:

- Legal risk: Do APIs use legally reliable sources such as OFAC and the IRS?

- Operational risk: Are organisations’ continuity during audits or grant payments guaranteed by API integrations?

- Reputational risk: Can data pipelines withstand fraud, disinformation, or cyberattacks?

Just a few nonprofit boards conduct frequent reviews of their technology strategy. However, those that did had a much higher chance of preserving donor confidence following data breaches or noncompliance.

2. Establishing a Framework for API Risk

Secondly, nonprofits should have a strategic API framework that consists of:

- Credibility Mapping of Sources: Give top priority to APIs that use regulated or official government data sources.

- Points of Integration: Determine which critical processes—grantee verification, vendor payments, and donor onboarding—can incorporate API governance.

- Risk Scoring Mechanisms: To assign and modify risk levels across transactions, geographies, or partners, use data collected from APIs.

- Feedback Loops: Build dashboards that allow board decision-making to be informed by real-time API data.

3. Using Cross-Functional Teams to Operate

Internal silos between the program, finance, legal, and IT departments are a common problem for nonprofit organisations.

These domains are naturally traversed by APIs. The creation of cross-functional API stewardship teams by leadership is required to:

- Finding the most important data governance priorities

- Supervising the use of ethical data

- Maintaining compliance changes via communicating with external API providers

The Institute of Internal Auditors‘ (IIA) Three Lines Model is mirrored in this governance model, where:

- APIs are used by frontline workers to make daily decisions.

- Management makes certain that connectors and controls are operating properly.

Independent confirmation that the API ecosystem facilitates enterprise risk management is provided via internal audit.

VII

Towards the Future: Nonprofit Accountability Driven by APIs

The role that APIs play in nonprofit governance will evolve from innovation to expectation as the digital ecosystem becomes more established. API-accessible compliance data will become more and more of a requirement for donors, particularly institutional funders and philanthropic tech platforms that provide grants.

Also, nonprofit tax statuses and beneficiary information may need to be validated using standardised interfaces per government regulations. Platforms for continuous assurance will incorporate APIs. In summary,

API-native governance will be a requisite. Emerging technologies like blockchain and AI will further amplify this change. Smart contracts could automate grant payout once regulatory checks (via APIs) are cleared, while APIs will feed real-time data into AI-powered fraud detection models.

By adopting this infrastructure-first strategy, nonprofits will not only reduce their risk profile but also shorten funding cycles, cut expenses, and create long-lasting trust.

Policy Consequences and Sector-Wide Transformation

Action must be taken in response to this transition at the organisational and nonprofit ecosystem levels. Expanding open-access APIs and standardising data standards are imperative for regulators (such as the IRS, OFAC, and state charity registers). Likewise, technology providers must consider nonprofit realities while designing APIs, such as multilingual data environments, tight budgets, and strict regulations. Incorporating data governance and API strategy into training and certification programs is also imperative for boards and sector groups.

The adoption of technology is slow in the nonprofit sector due to structural limitations. However, APIs might offer a unique combination of scalability, affordability, and regulatory readiness. This will be a digital leveller that puts strong governance within everyone’s reach.

Conclusion

The new infrastructure is trust. Trust is the foundation of the nonprofit sector – mutual trust between organisations and donors and confidence between beneficiaries and implementers. Additionally, compassion shouldn’t be sacrificed for loyalty.

APIs are incredibly human in the context of nonprofit risk management and governance, despite their seemingly technical appearance. They enable us to create systems that guarantee mission integrity, continual compliance, and verifiable truth. Nonprofits that integrate APIs as strategic infrastructure rather than merely tools will be at the forefront of the next era of philanthropic trust. This is especially as organisations manage the increasing risks of digital disruption, international regulation, and public scrutiny.

Register for your free Nonprofit Check Plus API Account today.