I

Introduction

Financial planning is crucial for the successful operation of a nonprofit. However, it entails evaluating an organisation’s overall cash flows, projecting the outcomes of different financing, investment, and dividend choices, and weighing the pros and drawbacks of each option.

Also, financial planning serves as the foundation for a practical business plan that is quantifiable and time-bound. This is because it increases the motivation to strive toward predetermined financial goals.

Setting financial goals and assigning tasks can help ensure the sustainability of an organisation. Likewise, employees’ motivation can be increased when they meet budgetary targets through rewards and recognition.

In this article, we will consider effective financial planning practices for nonprofits.

II

What is Financial Planning?

Financial planning is the process of translating an organisation’s overarching goals, strategies, and other plans into financial terms. Accordingly, financial resources are continuously directed and allocated as part of the financial planning process to achieve strategic goals and objectives. All things considered, budgets are the result of financial planning.

The secret to increasing shareholder value is to comprehend past performance and use that knowledge to establish forward-looking goals that will connect organisational outcomes with the corporate strategy.

A financial plan constitutes sets of financial accounts that project the effects of corporate choices on resources. For instance, an organisation choosing to undertake a community project will prepare a budget that considers the resources needed and the financial results that will justify their use.

All in all, the four processes of financial planning include budgeting, financial planning, inventory planning, and working capital management. Decisions on financing plans are mostly concerned with how to cover costs and investments. Hence, a nonprofit must choose the most effective way to finance its commitments.

III

Critical Financial Planning Statistics to Consider

In this section, we will consider statistics in financial planning that emphasise its importance for nonprofits.

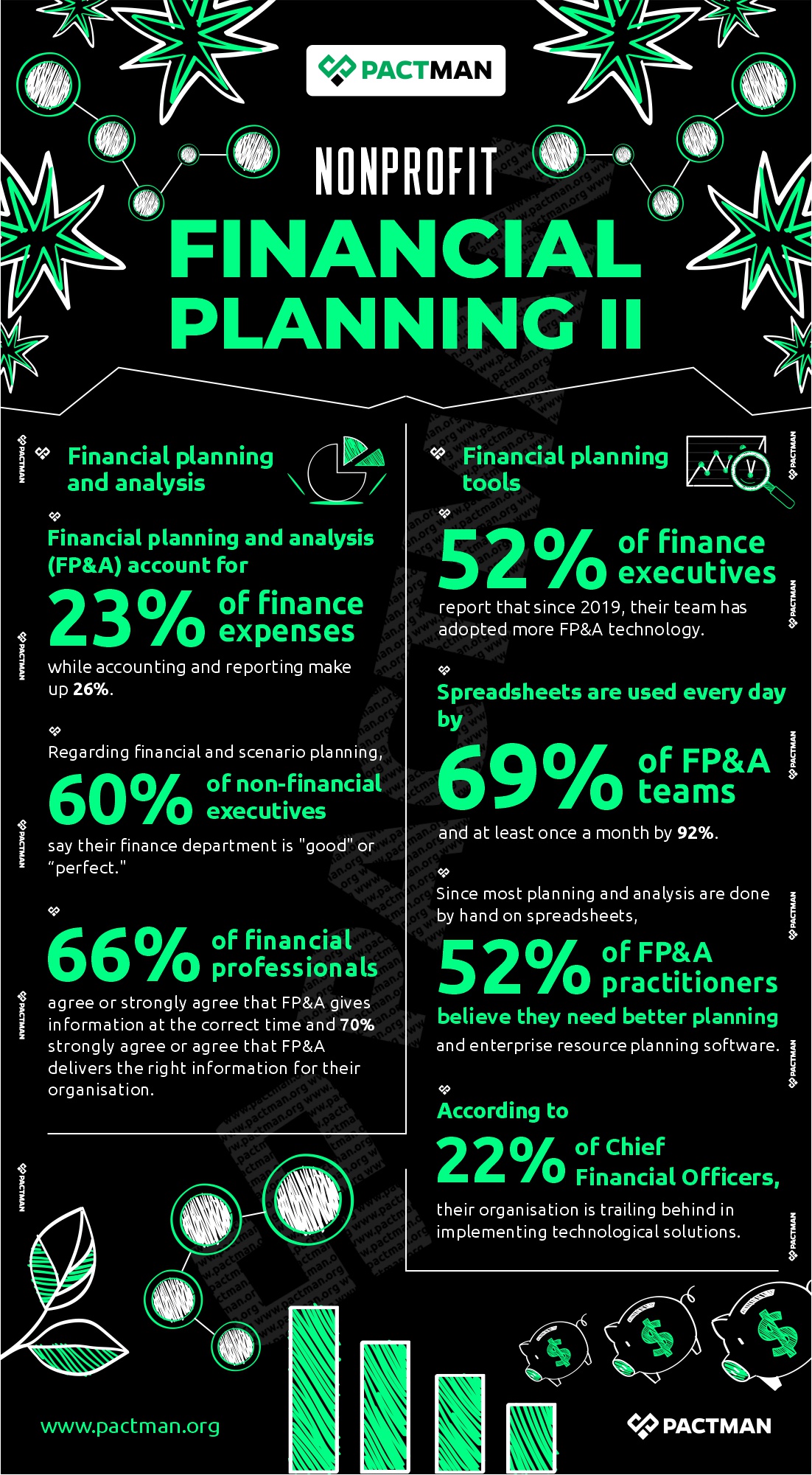

1. Financial planning and analysis

Financial planning and analysis (FP&A) account for 23% of finance expenses while accounting and reporting make up 26%. Also, when it comes to financial and scenario planning, 60% of non-financial executives say their finance department is “good” or “perfect.”

66% of financial professionals agree or strongly agree that FP&A provides information at the right time and 70% of them strongly agree or agree that FP&A delivers the right information for their organisation.

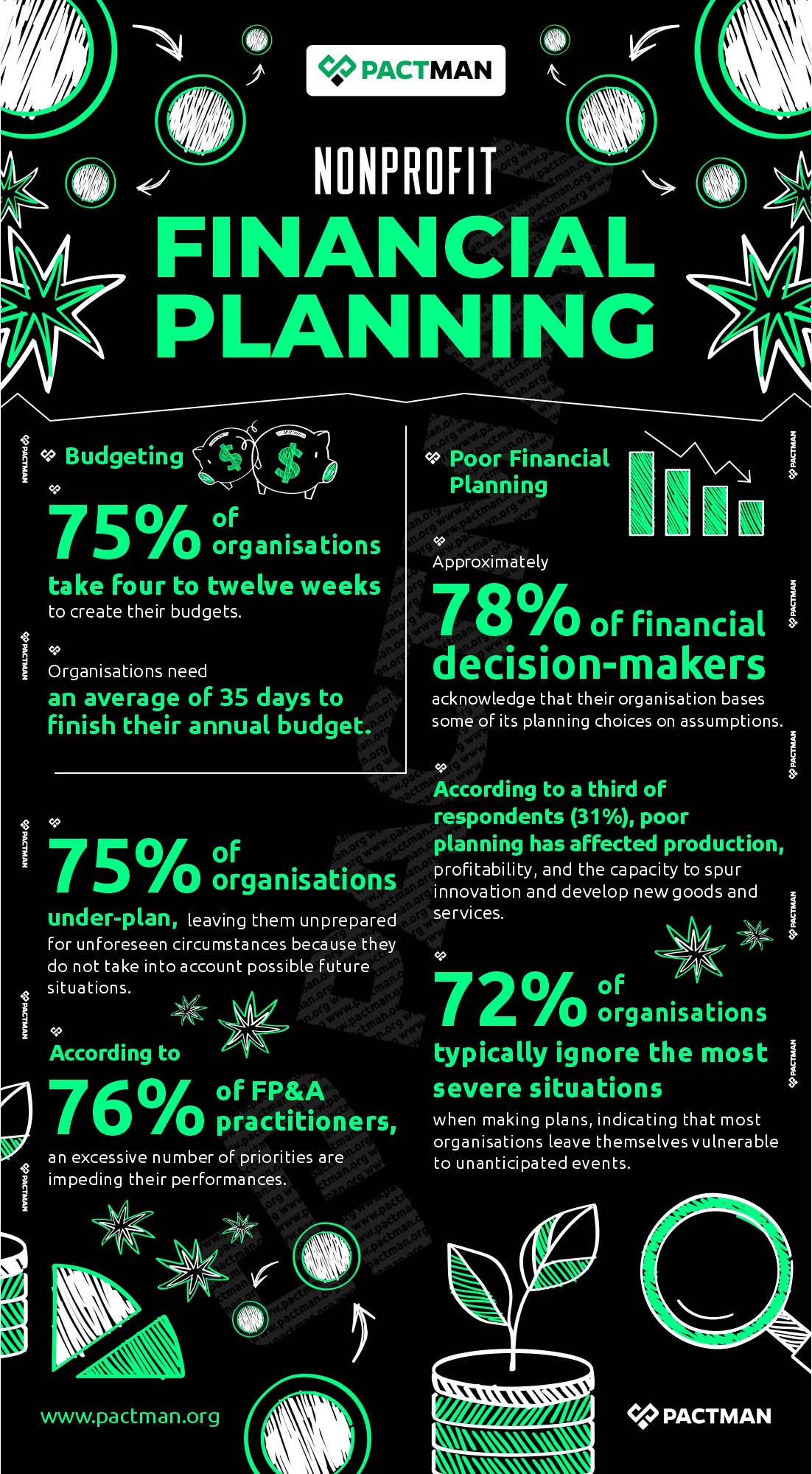

2. Budgeting

75% of organisations take four to twelve weeks to create their budgets. Likewise, organisations need an average of 35 days to complete their annual budget.

3. Financial planning tools

52% of finance executives report that since 2019, their team has adopted more FP&A technology. Spreadsheets are used every day by 69% of FP&A teams and at least once a month by 92%.

Since most planning and analysis are done by hand on spreadsheets, 52% of FP&A practitioners believe they need better planning and enterprise resource planning software. According to 22% of Chief Financial Officers, their organisation is trailing behind in implementing technological solutions.

4. Poor financial planning

Approximately 78% of financial decision-makers acknowledge that their organisation bases some of its planning choices on assumptions. Taken together, these results point to a widespread difficulty among financial planners in putting data-driven decision-making into practice.

According to a third of respondents (31%), poor planning has affected production, profitability, and the capacity to spur innovation and the development of new goods and services.

72% of organisations typically ignore the most severe situations when making plans, indicating that most organisations are leaving themselves vulnerable to unanticipated events. Also, 75% of organisations under-plan, leaving them unprepared for unforeseen circumstances because they do not take into account possible future situations.

According to 76% of FP&A practitioners, an excessive number of priorities are impeding their performances.

IV

Financial Performance and Financial Planning

Financial performance is the process of measuring the results of an organisation’s policies and operations in monetary terms. It is used to measure a nonprofit’s overall financial health over a given period of time. Also, it can be used to compare similar organisations across the same industry or to compare industries or sectors in aggregation.

Financial performance is mainly measured by financial statements. We will define a financial statement as an organised collection of data according to logical and consistent accounting procedures. Essentially, its purpose is to convey an understanding of some financial aspects of a firm. An Income Statement reveals a series of operations over a specified period. Likewise, a Balance Sheet shows a position at a specific moment in time.

Also, financial performance can refer to the general well-being of a nonprofit as far as finance is concerned within a certain period. Financial Performance directly focuses on aspects that affect the financial statements or reports of an organisation. Conversely, the financial performance analysis can deal with areas such as sales turnover for nonprofits that undertake business initiatives, capital employed, and asset base among others.

By all means, financial performance is a crucial indicator or measure of some economic units’ success. This could be in the achievement of set goals and objectives. More often than not, stakeholders are mostly interested in the organisation’s performance.

Financial health measurement

The financial health of a firm is measured using the following perspectives;

- Working capital Analysis

- Financial structure Analysis

- Activity Analysis and

- Profitability Analysis

In addition, the financial performance of not-for-profit organisations can be defined in terms of financial accountability. Overall, it remains one of the key elements in measuring performance and evaluating nonprofit effectiveness. As far as donors and community stakeholders are concerned, financial accountability primarily focuses on a nonprofit’s reputation for fiscal transparency and honesty. Also, accountability is represented by revealed data which show the use of external independent auditors and operating standards.

Performance in this context can relate to the completion of work as evaluated against predetermined benchmarks for speed, accuracy, completeness, and cost. Hence, financial performance is the extent to which the objectives of the organisation such as financial objectives will be met or have been met.

V

Top Financial Planning Statements for Nonprofits

Organisations frequently undertake projects and initiatives. This in turn requires funding and making financial choices. Recording and tracking funds, estimating future needs, and choosing when and how to place orders are all part of inventory management. Also, financial planning evaluates issues that occur while trying to manage current assets and current liabilities and the relationships that exist between them.

In this section, we will consider crucial financial statements that Nonprofits must prioritise in financial planning.

a. Cash Flow Worksheet and Statement

A cash flow worksheet can help a nonprofit examine the projected inflows and outflows of funds over a certain time frame. In a cash flow worksheet, line items are recorded as receipts and disbursements instead of revenues and expenses. More specifically, the cash flow worksheet can assist a nonprofit in discovering if it has enough cash on hand to cover its monthly expenses.

A cash flow worksheet and an annual budget are also different in that the latter budget for expenses that must be paid for in a specific month. On the other hand, an annual budget considers the expenses for the entire year rather than the specific period in which they occur.

Through cash flow projections, an organisation can ascertain whether a cash flow issue will arise. Also, by estimating its financial flow over four months, the organisation can predict if it will experience a deficit in a given month. Furthermore, an organisation can identify specific areas contributing to the shortfall, including the decline in grant revenues and the rise in rent-related costs.

Put simply, a cash flow statement shows a nonprofit where its fund came from and how it was used. The net effect of operations (revenues less expenses), or the operational surplus, is examined in the cash flow statement. In addition, it examines the received non-revenue funds, including loans and advances. Other areas of examination include payments made for non-expense items. This includes inventory, equipment, prepaid expenses, loans, or instalments and adjustments to the balances of accounts payable and receivable.

b. Balance Sheet

Secondly, the balance sheet of the organisation is among the most essential records that a nonprofit can offer for internal administration. The balance sheet provides external entities with financial information. There are other names for the balance sheet, including the Statement of Financial Position and Statement of Financial Condition.

For the most part, the cash flow statement and the balance sheet work in tandem. While the balance sheet reports the current financial situation, the cash flow statement reveals what funds we expect to have on hand to pay bills and other obligations as they come due. Stated differently, the balance sheet shows you what you own (assets) like cash and equipment compared to what you owe (liabilities) like loans. Nonprofit accounting systems are made to record the organisation’s financial status and economic activity.

The Accounting Equation is the foundation upon which the financial statements are built. It states:

Assets = Liabilities + Net Assets

By and large, the organisation’s net assets are shown by the difference between its assets and liabilities.

Maintaining an assets-to-liabilities ratio of 2:1 is a solid general rule of thumb. If the organisation’s obligations exceed its assets, serious financial issues may arise. Also, examining the organisation’s resources should be the second stage in analysing the balance sheet. Lastly, management must assess the organisation’s debt and figure out when these unpaid obligations are due.

Accounts payable, grants payable, refundable advances, third-party debt, long-term debt, unrestricted assets, temporarily restricted assets, and permanently restricted assets are the most frequent categories of liabilities for an organisation.

c. Operating Statement

The Statement of Activity, Income Statement, or Operating Statement is the third report in a full set of financial statements. The operating statement provides an overview of the evolution of the organisation’s operations and net assets over time. This change in net assets is expressed by the generic equation:

Revenues – Expenses = Change in Net Assets

The shift in net assets indicates a deficit or a surplus. Also, the three categories of unrestricted, temporarily restricted, and permanently restricted funds are often separated out in the operating statement.

An organisation must ascertain the donor’s intent when it receives cash or revenues. This is then documented and classified as unrestricted, temporarily restricted, or permanently limited funds. Consequently, the funds can only be used for certain purposes if a donor places restrictions on them. However, the giver is not entitled to a reimbursement for their contribution. Upon removal of the limitation, an asset can be relocated from the temporarily restricted column. Afterwards, the asset can be classified as unrestricted, and an organisation is free to spend the fund how it sees fit.

Funds that are permanently limited cannot be transferred unless the donor’s complete intent is fulfilled by the organisation, or the time period for the funds expires. Also, a condition may be imposed by the donor when a fund is donated. Until the condition is satisfied as specified by the donor, a donation is regarded as a liability. Consequently, the donation cannot be recorded as revenue.

d. Budgets

A budget is a plan for carrying out programs. By and large, it includes goals and objectives, a set time frame, an estimation of the resources needed, an estimate of the resources available, a comparison with one or more previous periods, and a demonstration of the requirements for the future. Thus, the budgeting process arranges an organisation’s operations in a way that promotes its overall well-being.

An organisation’s anticipated costs and income for a specific time period are displayed in the budget. Conversely, the organisation’s activities and services incorporate basic budgeting. This helps to decide planning procedures, assessment techniques, service prices, event scheduling, and expenses associated with accomplishing the organisation’s goal.

In budgeting, there are five essential steps:

1. First, estimate expenses

This can be simply calculated by multiplying the required number of personnel, supplies, space, etc. by the expected cost per unit of each of those items. This process is often handled by the employee who is most knowledgeable about the specifics. Afterwards, a preliminary spending plan should be presented to the board for consideration and approval.

2. Next, approximate prospective revenue streams

In this case, the board members and other fundraisers are the most effective in achieving the process. Among other things, sources could be fund drives, grants, and service fees.

3. Adjust expenses to reflect reality.

Before a balanced budget can be created, an organisation must balance its predicted income and expenses.

4. After adjustments, the board must examine and adopt the final proposed budget.

Lastly, the budget should be reviewed regularly throughout the year to see if predicted and actual income and expenses match up. If not, the budget needs to be updated and altered if there is a significant deviation (amounts over or under budget). Only then will the budget be useful.

A broad list of the most typical forms of income can be used as a starting point for a nonprofit’s revenue estimation. By dividing the total amount spent on each line per quarter, it is possible to calculate dues, individual contributions, and investment income.

Also, when preparing estimates for the next year, an organisation should take into account the state of the economy and its planned programs.

Examining and determining the reason for differences between budgeted and actual income and expenses is the core of budgetary control. Hence, budgets for grants, fundraising, foundation support, and government assistance should be made cautiously. An organisation should consider deadlines, contribution caps, and associated costs when applying for grants or engaging in other forms of fundraising.

Also, examining the activities scheduled for the next year might help an organisation predict costs. The support services required to carry out activities program by program should be thoroughly examined by an organisation after evaluating predicted revenues. Included in this estimation should be: the number of people to complete the activity or program; the area and equipment required to finish the job; and expenses for mailers, transportation, advertising, and other materials.

Lastly, a nonprofit can estimate the quantity and nature of resources that will be given as in-kind gifts. Estimates should also be made for other costs that might arise from the particular services the nonprofit provides.

Conclusion

High success records for nonprofit organisations are contingent upon the implementation of favourable financial planning techniques. For nonprofits to secure funding in the future, they must be accountable to the organisations and people who assist them with funding. In like manner, prepared financial reports result in successful finances.

Also, examining the financial statements and the notes that go with them in great detail is a smart way to begin when conducting a financial statement analysis. Three main areas should be prioritised in the assessment of the claims. First and foremost, the nonprofit has to assess if its current financial management strategy is serving the organisation’s stated purpose. Secondly, the investigation ought to ascertain the organisation’s financial stability and juxtapose it with the general patterns observed in the nonprofit domain. Third, the financial statements ought to display the outcomes of the nonprofit’s service endeavours.

3 Responses