I

Introduction

The philanthropic sector relies on grantmaking for its survival. Proposal reviews, due diligence, compliance checks, reporting, and monitoring are just a few of the complex procedures that come with grant administration costs behind every dollar given. The Center for Effective Philanthropy (CEP) states that, depending on the size and maturity of the organization’s systems, these expenses may account for 10–20% of grant expenditures overall.

Today’s dilemma for the majority of foundations is straightforward: how to cut administrative costs without sacrificing the integrity and quality of grantmaking. As we all know, accountability or impact should never be sacrificed for efficiency. Although minimizing the administrative expense ratio is a reasonable goal, doing so at the expense of quality—the thorough due diligence, strategic thinking, and solid grantee relationships—often results in a hollowed-out organization.

Presently, the modern issue is not cutting costs. Rather, it is redesigning the administrative core to devote all available financial and human resources to the tasks that generate the greatest value. In this article, we outline key pillars for achieving high-quality, low-cost grant administration by referencing best practices in organizational excellence.

II

Critical Statistics on Grant Administration Costs

In this section, we will consider critical statistics on grant administration and its relevance to the entire operation.

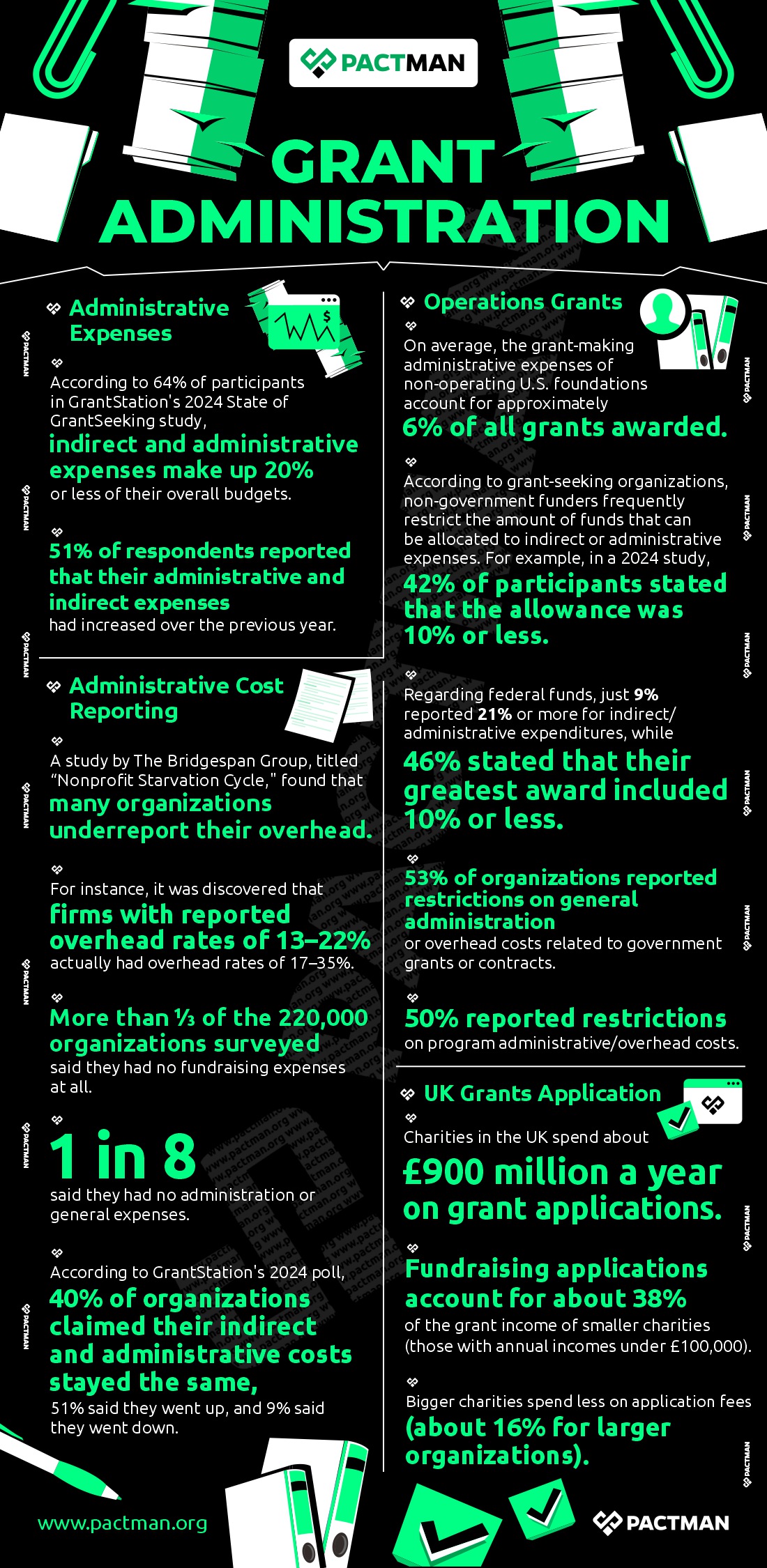

a. Administrative Expenses

According to 64% of participants in GrantStation’s 2024 State of GrantSeeking study, indirect and administrative expenses make up 20% or less of their overall budgets. Additionally, 51% of respondents reported that their administrative and indirect expenses had increased over the previous year.

b. Operations grants

On average, the grant-making administrative expenses of non-operating U.S. foundations account for approximately 6% of all grants awarded. According to grant-seeking organizations, non-government funders frequently restrict the amount of funds that can be allocated to indirect or administrative expenses. For example, in a 2024 study, 42% of participants stated that the allowance was 10% or less.

Regarding federal funds, just 9% reported 21% or more for indirect/administrative expenditures, while 46% stated that their greatest award included 10% or less.

Also, 53% of organizations reported restrictions on general administration or overhead costs related to government grants or contracts, and 50% reported restrictions on program administrative/overhead costs.

c. Administrative cost reporting

A study by The Bridgespan Group, titled “Nonprofit Starvation Cycle,” found that many organizations underreport their overhead. For instance, it was discovered that firms with reported overhead rates of 13–22% actually had overhead rates of 17–35%. Also, more than ⅓ of the 220,000 organizations surveyed said they had no fundraising expenses at all, and 1 in 8 said they had no administration or general expenses.

Likewise, according to GrantStation’s 2024 poll, 40% of organizations claimed their indirect and administrative costs stayed the same, 51% said they went up, and 9% said they went down.

d. UK Grant Applications

Charities in the UK spend about £900 million a year on grant applications. Fundraising applications account for about 38% of the grant income of smaller charities (those with annual incomes under £100,000). On the other hand, bigger charities spend less on application fees (about 16% for larger organizations).

III

How to Curtail Grant Administration Costs Without Compromise on Quality

Intelligent reallocation, not personnel reduction, is the key to strategic efficiency in grantmaking. In this section, we will consider effective practices to curtail grant administration costs while still embracing quality standards.

1. Using Lean Principles to Re-Architect Processes

Numerous administrative responsibilities stem from inherited procedures that were never scaled or optimized for complexity. By adopting lean concepts, foundations can get rid of “waste” (any action that doesn’t improve the mission, the recipient, or the decision-making process).

a. Make the Application Process Unique:

The cycle of applications and reports is the biggest administrative burden for grantees and foundations alike. Hence, a one-size-fits-all strategy makes large, established institutions and small, early-stage grantees face the same degree of scrutiny, which is extremely resource-intensive. By and large, the answer is Different Levels of Due Diligence.

To begin with, segment grantees using a risk-based evaluation, then modify administrative requirements as necessary.

- Low-Risk/High-Trust Tier (General Operating Support): Make the switch to Trust-Based Philanthropy for organizations with a long history or those that receive grants frequently. Furthermore, limit applications to a brief discussion or a single letter of inquiry (LOI). Instead of using traditional financial reporting, use the grantee’s current, standard annual report.

- Medium risk tier (specific to a project): Secondly, keep the budget and storyline requirements the same, but use technology to automate data tracking and extraction.

- High-Risk Tier (High-Complexity/New Grantees): Only concentrate intense due diligence efforts on this tier, which calls for thorough capability evaluations and financial analysis. Due to the limited size of this group, the investment is high-value and targeted.

b. Transition from Adherence to Knowledge

Conventional grant management places a strong emphasis on rigid budget line item conformance, which frequently inhibits creativity and adaptability. Hence, by shifting the administrative team’s emphasis from compliance checks to strategic learning, costs are justified by generating organizational insights.

- Actionable Reporting: Request that grantees report on more than simply spending categories; ask them to report on outcomes and important lessons learned. From reviewing receipts, the administrative team’s responsibilities also include combining performance data. This, in turn, directly influences board choices and future grant strategies.

2. Utilizing Technology to Strengthen the Digital Core

Technology shouldn’t just digitize outdated forms; it should also automate repetitive, low-value operations. As a result, highly qualified employees (program officers) can concentrate on high-value work (developing relationships, planning).

a. Establish a unified grant management system (GMS)

The cornerstone of strategic effectiveness is a contemporary GMS. When administrative data is dispersed among disparate spreadsheets, email accounts, and physical files, the hidden costs of data search, reconciliation, and verification soon surpass the cost of a reliable solution.

- Autonomy Hotspots: Pay attention to automation on:

- Automated Data Validation: This process compares TINs, legal names, and 501(c)(3) status with external databases automatically using optical character recognition (OCR) or structured data input.

- Automated Payment Scheduling: By doing away with human check requests, it ensures fast and consistent financial flow for grantees.

- Automated Correspondence: Grant agreements that are already filled out, reminders for reporting, and uniform rejection letters.

b. Data Synthesis and Benchmarking using AI

Now more than ever, new technologies provide advanced methods for processing unstructured data and transforming unprocessed data into strategic intelligence.

- Financial Health Benchmarking: Use technologies to automatically compare grantee financial documents (such as Form 990s) to the financial statements of peers in the industry, rather than manually analyzing spreadsheets. This drastically cuts down on administrative work by expediting financial review and immediately identifying irregularities.

- Narrative Synthesis: Utilize machine learning models to examine hundreds of grantee reports to identify recurring themes, difficulties, or achievements. By doing this, the program team may quickly identify systemic problems and avoid spending hundreds of hours examining reports by hand.

3. Redefining Employee Roles to Create Value

Lastly, human capital is the most costly resource in any foundation. When highly paid employees are only assigned to activities requiring human judgment, empathy, and strategic insight, optimization is accomplished.

a. Professionalise and centralise support services

Program officers are frequently overburdened with low-value administrative duties (e.g., scheduling, file maintenance, basic budget review). This expertise application is not optimal.

- Create a Central Administration Team for Grants: The GMS, compliance checklists, payment processing, and data integrity management should all be the exclusive focus of a dedicated staff, no matter how small. This centralized service approach frees up program staff to concentrate on strategy and field involvement while guaranteeing consistency.

- Utilize Common Services: For smaller foundations, consider sharing back-office services with other nonprofits. This is especially for tasks like IT assistance, legal review, and payroll. Essentially, this will allow them to take advantage of economies of scale that are typically only available to larger organizations.

b. Invest in Grantee Capacity

Although grantee training may appear like an additional expense at first, improving grantee organizational and financial literacy is the best long-term cost-cutting measure.

- Standardized Equipment: Make basic, cost-free templates available to grantees for tracking their budgets and reporting results. By and large, it saves time and money for both grantee and your administrative staff. Also, it allows grantees to clarify and resubmit a well-structured report that satisfies requirements on the first submission.

- The “No-Wrong-Door” policy: Encourage grantees to make inquiries early. A quick phone call to clarify a budget item before submission is far less expensive than the work required to make corrections after submission.

Conclusion

Cost optimization for grant administration is a strategic development rather than just an operational undertaking. Grantmaking foundations can declare lower overhead ratios with confidence when they implement tiered due diligence, automate the digital core, and professionalize the administrative function. Also, it ensures that the quality and impact of their work have been purposefully improved rather than compromised. The objective is to transition from being a proficient check processor to an adaptable change investor.

One Response